Form Dr-14 - Consumer'S Certificate Of Exemption

ADVERTISEMENT

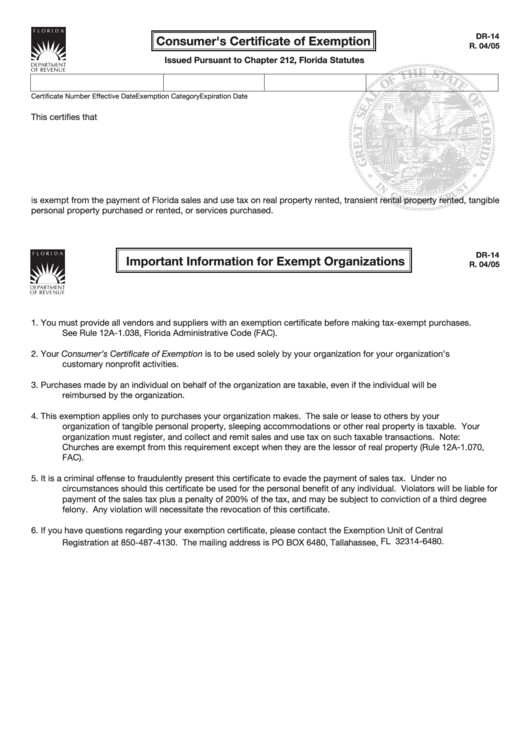

DR-14

Consumer's Certificate of Exemption

R. 04/05

Issued Pursuant to Chapter 212, Florida Statutes

Certificate Number

Effective Date

Expiration Date

Exemption Category

This certifies that

is exempt from the payment of Florida sales and use tax on real property rented, transient rental property rented, tangible

personal property purchased or rented, or services purchased.

DR-14

Important Information for Exempt Organizations

R. 04/05

1.

You must provide all vendors and suppliers with an exemption certificate before making tax-exempt purchases.

See Rule 12A-1.038, Florida Administrative Code (FAC).

2.

Your Consumer’s Certificate of Exemption is to be used solely by your organization for your organization’s

customary nonprofit activities.

3.

Purchases made by an individual on behalf of the organization are taxable, even if the individual will be

reimbursed by the organization.

4.

This exemption applies only to purchases your organization makes. The sale or lease to others by your

organization of tangible personal property, sleeping accommodations or other real property is taxable. Your

organization must register, and collect and remit sales and use tax on such taxable transactions. Note:

Churches are exempt from this requirement except when they are the lessor of real property (Rule 12A-1.070,

FAC).

5.

It is a criminal offense to fraudulently present this certificate to evade the payment of sales tax. Under no

circumstances should this certificate be used for the personal benefit of any individual. Violators will be liable for

payment of the sales tax plus a penalty of 200% of the tax, and may be subject to conviction of a third degree

felony. Any violation will necessitate the revocation of this certificate.

6.

If you have questions regarding your exemption certificate, please contact the Exemption Unit of Central

Registration at 850-487-4130. The mailing address is PO BOX 6480, Tallahassee, FL 32314-6480.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1