Publication 503 - Child And Dependent Care Expenses - 2002 Page 3

ADVERTISEMENT

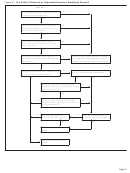

Figure A. Can You Claim the Credit?

Start Here

No

Was the care for one or more qualifying persons?

Yes

1

Did you

keep up a home for you and that qualifying person or

No

persons?

Yes

No

2

Did you

have earned income during the year?

Yes

No

2

Did you pay the expenses to allow you

to work or look for work?

Yes

Were your payments made to someone you or your spouse could

Yes

claim as a dependent?

No

Were your payments made to your child who was under the age of

Yes

19 at the end of the year?

No

Are you single?

Yes

No

Are you filing a joint return?

Yes

No

No

Do you meet the requirements

to be considered unmarried?

Yes

Yes

Do you know the care provider’s name,

address, and identifying number?

No

No

Did you make a reasonable effort to get this

information? (See Due diligence.)

Yes

Did you exclude at least $2,400 of dependent

Yes

care benefits ($4,800 if two or more qualifying

persons)?

No

You CAN claim the child and dependent

You CANNOT claim the child

care credit. Fill out Form 2441 or

3

and dependent care credit.

Schedule 2 (Form 1040A).

1

This includes your spouse if you were married.

2

This also applies to your spouse, unless your spouse was disabled or a full-time student.

3

If you had expenses that met the requirements for 2001, except that you did not pay them until 2002, you may be able to claim those expenses in 2002. See

Expenses not paid until the following year under How To Figure the Credit.

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22