Publication 503 - Child And Dependent Care Expenses - 2002 Page 13

ADVERTISEMENT

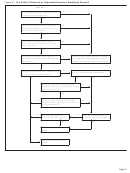

12,000

14,000

28%

on only $1,400 of the $1,900 work-related expenses he

14,000

16,000

27%

paid. This is because his dollar limit is reduced as shown

16,000

18,000

26%

next.

18,000

20,000

25%

20,000

22,000

24%

George’s Reduced Dollar Limit

22,000

24,000

23%

24,000

26,000

22%

1) Maximum allowable expenses for one

26,000

28,000

21%

qualifying person . . . . . . . . . . . . . . . . . . . . . . . .

$2,400

28,000

No limit

20%

2) Minus: Dependent care benefits George

−1,000

excludes from income . . . . . . . . . . . . . . . . . . . . .

3) Reduced dollar limit on expenses George

Payments for previous year’s expenses. If you had

can use for the credit . . . . . . . . . . . . . . . . . . . . .

$1,400

work-related expenses in 2001 that you paid in 2002, you

may be able to increase the credit on your 2002 return.

Amount of Credit

Attach a statement to your form showing how you figured

the additional amount from 2001. Then write “CPYE” and

To determine the amount of your credit, multiply your

the amount of the credit on the dotted line next to line 9 on

work-related expenses (after applying the earned income

Form 2441 or in the space to the left of line 9 on Schedule 2

and dollar limits) by a percentage. This percentage de-

(Form 1040A). Also write the name and taxpayer identifica-

pends on your adjusted gross income shown on line 36 of

tion number of the person for whom you paid the prior

Form 1040 or line 22 of Form 1040A. The following table

year’s expenses. Then add this credit to the amount on line

shows the percentage to use based on adjusted gross

9, and replace the amount on line 9 with the total.

income.

Example. In 2001, Sam and Kate had child-care ex-

IF your adjusted gross income is:

THEN the

penses of $2,600 for their 12-year-old child. Of the $2,600,

Over

But not over

percentage is:

they paid $2,000 in 2001 and $600 in 2002. Their adjusted

$

0

$10,000

30%

gross income for 2001 was $30,000. Sam’s earned income

10,000

12,000

29%

of $14,000 was less than Kate’s earned income. A credit

Filled−In Worksheet 1. Worksheet for 2001 Expenses Paid in 2002— Illustration for Sam

and Kate’s Example.

(Note: Use this worksheet to figure the credit you may claim for 2001 expenses paid in 2002.)

1. Enter your 2001 qualified expenses paid in 2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

$ 2,000

2. Enter your 2001 qualified expenses paid in 2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

600

3. Add the amounts on lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

2,600

4. Enter $2,400 if care was for one qualifying person ($4,800 if for two or more) . . . . . . . . . .

4.

2,400

5. Enter any dependent care benefits received for 2001 and excluded from your income (from

line 18 of 2001 Form 2441 or Schedule 2 (Form 1040A)) . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

0

6. Subtract amount on line 5 from amount on line 4 and enter the result . . . . . . . . . . . . . . . .

6.

2,400

7. Compare your earned income for 2001 and your spouse’s earned income for 2001 and

enter the smaller amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

14,000

8. Compare the amounts on lines 3, 6, and 7 and enter the smallest amount . . . . . . . . . . . . .

8.

2,400

9. Enter the amount on which you figured the credit for 2001 (from line 6 of 2001 Form 2441

or Schedule 2 (Form 1040A)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

2,000

10. Subtract amount on line 9 from amount on line 8 and enter the result. If zero or less, stop

here. You cannot increase your credit by any previous year’s expenses . . . . . . . . . . . . . . 10.

400

11. Enter your 2001 adjusted gross income (from line 33 of your 2001 Form 1040 or line 19 of

your 2001 Form 1040A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

30,000

12. Find your 2001 adjusted gross income in the table of percentages (shown earlier) and

enter the corresponding decimal amount here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

.20

13. Multiply line 10 by line 12. Add this amount to your 2002 credit and enter the total on line 9

of your 2002 Form 2441 or Schedule 2 (Form 1040A). Write “CPYE,” the amount of this

credit for a prior year’s expenses, and the name and taxpayer identification number of the

person for whom you paid the prior year’s expenses on the dotted line next to line 9 of

Form 2441 or in the space to the left of line 9 on Schedule 2 (Form 1040A) . . . . . . . . . . . . 13.

$

80

Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22