Publication 503 - Child And Dependent Care Expenses - 2002 Page 12

ADVERTISEMENT

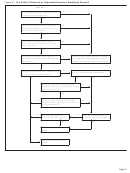

Worksheet 1. Worksheet for 2001 Expenses Paid in 2002

(Note: Use this worksheet to figure the credit you may claim for 2001 expenses paid in 2002.)

1. Enter your 2001 qualified expenses paid in 2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Enter your 2001 qualified expenses paid in 2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Add the amounts on lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Enter $2,400 if care was for one qualifying person ($4,800 if for two or more) . . . . . . . . . .

4.

5. Enter any dependent care benefits received for 2001 and excluded from your income (from

line 18 of 2001 Form 2441 or Schedule 2 (Form 1040A)) . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Subtract amount on line 5 from amount on line 4 and enter the result . . . . . . . . . . . . . . . .

6.

7. Compare your earned income for 2001 and your spouse’s earned income for 2001 and

enter the smaller amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Compare the amounts on lines 3, 6, and 7 and enter the smallest amount . . . . . . . . . . . . .

8.

9. Enter the amount on which you figured the credit for 2001 (from line 6 of 2001 Form 2441

or Schedule 2 (Form 1040A)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Subtract amount on line 9 from amount on line 8 and enter the result. If zero or less, stop

here. You cannot increase your credit by any previous year’s expenses . . . . . . . . . . . . . . 10.

11. Enter your 2001 adjusted gross income (from line 33 of your 2001 Form 1040 or line 19 of

your 2001 Form 1040A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Find your 2001 adjusted gross income in the table of percentages (shown earlier) and

enter the corresponding decimal amount here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Multiply line 10 by line 12. Add this amount to your 2002 credit and enter the total on line 9

of your 2002 Form 2441 or Schedule 2 (Form 1040A). Write “CPYE,” the amount of this

credit for a prior year’s expenses, and the name and taxpayer identification number of the

person for whom you paid the prior year’s expenses on the dotted line next to line 9 of

Form 2441 or in the space to the left of line 9 on Schedule 2 (Form 1040A) . . . . . . . . . . . . 13.

expense. However, if they use the $2,750 first as a medical

Example. In July of this year, to permit your spouse to

expense, they cannot use any part of that amount to figure

begin a new job, you enrolled your 3-year-old daughter in a

the credit.

nursery school that provides preschool child care. You

paid $300 per month for the child care. You can use the full

$1,800 you paid ($300 × 6 months) as qualified expenses

Dollar Limit

since it is not more than the $2,400 yearly limit.

There is a dollar limit on the amount of your work-related

expenses you can use to figure the credit. This limit is

Reduced Dollar Limit

$2,400 for one qualifying person, or $4,800 for two or more

qualifying persons.

If you received dependent care benefits from your em-

ployer that you exclude from your income, you must sub-

If you paid work-related expenses for the care of

TIP

tract that amount from the dollar limit that applies to you.

two or more qualifying persons, the $4,800 limit

Your reduced dollar limit is figured on lines 22 through 26

does not need to be divided equally among them.

of Form 2441 or Schedule 2 (Form 1040A). See

For example, if your work-related expenses for the care of

one qualifying person are $2,000 and your work-related

Employer-Provided Dependent Care Benefits, earlier, for

information on excluding these benefits.

expenses for another qualifying person are $2,800, you

can use the total, $4,800, when figuring the credit.

Example. George is a widower with one child and earns

$24,000 a year. He pays work-related expenses of $1,900

Yearly limit. The dollar limit is a yearly limit. The amount

for the care of his 4-year-old child and qualifies to claim the

of the dollar limit remains the same no matter how long,

credit for child and dependent care expenses. His em-

during the year, you have a qualifying person in your

ployer pays an additional $1,000 under a qualified depen-

household. Use the $2,400 limit if you paid work-related

dent care benefit plan. This $1,000 is excluded from

expenses for the care of one qualifying person at any time

George’s income.

during the year. Use $4,800 if you paid work-related ex-

penses for the care of more than one qualifying person at

Although the dollar limit for his work-related expenses is

any time during the year.

$2,400 (one qualifying person), George figures his credit

Page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22