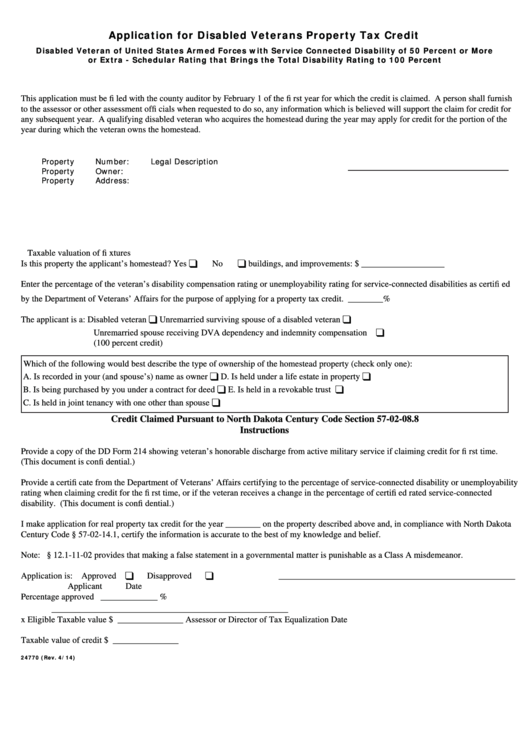

Application for Disabled Veterans Property Tax Credit

Disabled Veteran of United States Armed Forces with Service Connected Disability of 50 Percent or More

or Extra - Schedular Rating that Brings the Total Disability Rating to 100 Percent

This application must be fi led with the county auditor by February 1 of the fi rst year for which the credit is claimed. A person shall furnish

to the assessor or other assessment offi cials when requested to do so, any information which is believed will support the claim for credit for

any subsequent year. A qualifying disabled veteran who acquires the homestead during the year may apply for credit for the portion of the

year during which the veteran owns the homestead.

Property Number:

Legal Description

Property Owner:

Property Address:

Taxable valuation of fi xtures

Is this property the applicant’s homestead? Yes

No

buildings, and improvements: $ ___________________

Enter the percentage of the veteran’s disability compensation rating or unemployability rating for service-connected disabilities as certifi ed

by the Department of Veterans’ Affairs for the purpose of applying for a property tax credit. ________%

Unremarried surviving spouse of a disabled veteran

The applicant is a: Disabled veteran

Unremarried spouse receiving DVA dependency and indemnity compensation

(100 percent credit)

Which of the following would best describe the type of ownership of the homestead property (check only one):

A. Is recorded in your (and spouse’s) name as owner

D. Is held under a life estate in property

B. Is being purchased by you under a contract for deed

E. Is held in a revokable trust

C. Is held in joint tenancy with one other than spouse

Credit Claimed Pursuant to North Dakota Century Code Section 57-02-08.8

Instructions

Provide a copy of the DD Form 214 showing veteran’s honorable discharge from active military service if claiming credit for fi rst time.

(This document is confi dential.)

Provide a certifi cate from the Department of Veterans’ Affairs certifying to the percentage of service-connected disability or unemployability

rating when claiming credit for the fi rst time, or if the veteran receives a change in the percentage of certifi ed rated service-connected

disability. (This document is confi dential.)

I make application for real property tax credit for the year ________ on the property described above and, in compliance with North Dakota

Century Code § 57-02-14.1, certify the information is accurate to the best of my knowledge and belief.

Note: N.D.C.C. § 12.1-11-02 provides that making a false statement in a governmental matter is punishable as a Class A misdemeanor.

Application is: Approved

Disapproved

______________________________________________________

Applicant

Date

Percentage approved

_____________ %

______________________________________________________

x Eligible Taxable value $ _______________

Assessor or Director of Tax Equalization

Date

Taxable value of credit

$ _______________

24770 (Rev. 4/14)

1

1 2

2