Instructions For Form St-810.6 - Quarterly Schedule P For Part-Quarterly Filers - New York Department Of Taxation And Finance

ADVERTISEMENT

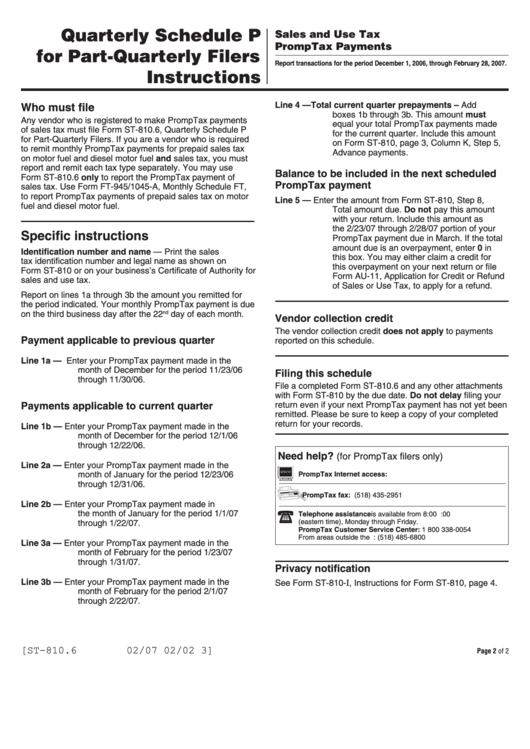

Quarterly Schedule P

Sales and Use Tax

PrompTax Payments

for Part-Quarterly Filers

Report transactions for the period December 1, 2006, through February 28, 2007.

Instructions

Line 4

—

Total current quarter prepayments – Add

Who must file

boxes 1b through 3b. This amount must

Any vendor who is registered to make PrompTax payments

equal your total PrompTax payments made

of sales tax must file Form ST-810.6, Quarterly Schedule P

for the current quarter. Include this amount

for Part-Quarterly Filers. If you are a vendor who is required

on Form ST-810, page 3, Column K, Step 5,

to remit monthly PrompTax payments for prepaid sales tax

Advance payments.

on motor fuel and diesel motor fuel and sales tax, you must

report and remit each tax type separately. You may use

Balance to be included in the next scheduled

Form ST-810.6 only to report the PrompTax payment of

PrompTax payment

sales tax. Use Form FT-945/1045-A, Monthly Schedule FT,

to report PrompTax payments of prepaid sales tax on motor

Line 5

—

Enter the amount from Form ST-810, Step 8,

fuel and diesel motor fuel.

Total amount due. Do not pay this amount

with your return. Include this amount as

the 2/23/07 through 2/28/07 portion of your

Specific instructions

PrompTax payment due in March. If the total

amount due is an overpayment, enter 0 in

Identification number and name — Print the sales

this box. You may either claim a credit for

tax identification number and legal name as shown on

this overpayment on your next return or file

Form ST-810 or on your business’s Certificate of Authority for

Form AU-11, Application for Credit or Refund

sales and use tax.

of Sales or Use Tax, to apply for a refund.

Report on lines 1a through 3b the amount you remitted for

the period indicated. Your monthly PrompTax payment is due

on the third business day after the 22

nd

day of each month.

Vendor collection credit

The vendor collection credit does not apply to payments

Payment applicable to previous quarter

reported on this schedule.

Line 1a — Enter your PrompTax payment made in the

month of December for the period 11/23/06

Filing this schedule

through 11/30/06.

File a completed Form ST-810.6 and any other attachments

with Form ST-810 by the due date. Do not delay filing your

Payments applicable to current quarter

return even if your next PrompTax payment has not yet been

remitted. Please be sure to keep a copy of your completed

return for your records.

Line 1b — Enter your PrompTax payment made in the

month of December for the period 12/1/06

through 12/22/06.

Need help?

(for PrompTax filers only)

Line 2a — Enter your PrompTax payment made in the

month of January for the period 12/23/06

PrompTax Internet access:

through 12/31/06.

PrompTax fax:

(518) 435-2951

Line 2b — Enter your PrompTax payment made in

the month of January for the period 1/1/07

Telephone assistance is available from 8:00 A.M. to 5:00 P.M.

through 1/22/07.

(eastern time), Monday through Friday.

PrompTax Customer Service Center:

1 800 338-0054

From areas outside the U.S. and outside Canada: (518) 485-6800

Line 3a —

Enter your PrompTax payment made in the

month of February for the period 1/23/07

through 1/31/07.

Privacy notification

Line 3b —

Enter your PrompTax payment made in the

See Form ST-810- I , Instructions for Form ST-810, page 4.

month of February for the period 2/1/07

through 2/22/07.

[ST-810.6

02/07 02/02 3]

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1