Schedule M1m Instructions - 2001

ADVERTISEMENT

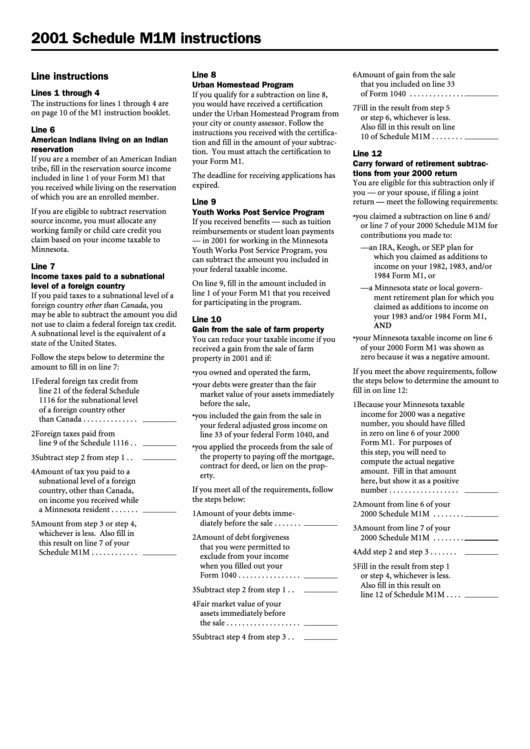

2001 Schedule M1M instructions

6 Amount of gain from the sale

Line 8

Line instructions

that you included on line 33

Urban Homestead Program

Lines 1 through 4

of Form 1040 . . . . . . . . . . . . . .

If you qualify for a subtraction on line 8,

The instructions for lines 1 through 4 are

you would have received a certification

7 Fill in the result from step 5

on page 10 of the M1 instruction booklet.

under the Urban Homestead Program from

or step 6, whichever is less.

your city or county assessor. Follow the

Also fill in this result on line

Line 6

instructions you received with the certifica-

10 of Schedule M1M . . . . . . . .

American Indians living on an Indian

tion and fill in the amount of your subtrac-

reservation

tion. You must attach the certification to

Line 12

If you are a member of an American Indian

your Form M1.

Carry forward of retirement subtrac-

tribe, fill in the reservation source income

tions from your 2000 return

The deadline for receiving applications has

included in line 1 of your Form M1 that

You are eligible for this subtraction only if

expired.

you received while living on the reservation

you — or your spouse, if filing a joint

of which you are an enrolled member.

Line 9

return — meet the following requirements:

If you are eligible to subtract reservation

Youth Works Post Service Program

• you claimed a subtraction on line 6 and/

source income, you must allocate any

If you received benefits — such as tuition

or line 7 of your 2000 Schedule M1M for

working family or child care credit you

reimbursements or student loan payments

contributions you made to:

claim based on your income taxable to

— in 2001 for working in the Minnesota

— an IRA, Keogh, or SEP plan for

Minnesota.

Youth Works Post Service Program, you

which you claimed as additions to

can subtract the amount you included in

income on your 1982, 1983, and/or

Line 7

your federal taxable income.

1984 Form M1, or

Income taxes paid to a subnational

On line 9, fill in the amount included in

level of a foreign country

— a Minnesota state or local govern-

line 1 of your Form M1 that you received

If you paid taxes to a subnational level of a

ment retirement plan for which you

for participating in the program.

foreign country other than Canada, you

claimed as additions to income on

may be able to subtract the amount you did

your 1983 and/or 1984 Form M1,

Line 10

not use to claim a federal foreign tax credit.

AND

Gain from the sale of farm property

A subnational level is the equivalent of a

• your Minnesota taxable income on line 6

You can reduce your taxable income if you

state of the United States.

of your 2000 Form M1 was shown as

received a gain from the sale of farm

zero because it was a negative amount.

Follow the steps below to determine the

property in 2001 and if:

amount to fill in on line 7:

If you meet the above requirements, follow

• you owned and operated the farm,

1 Federal foreign tax credit from

the steps below to determine the amount to

• your debts were greater than the fair

fill in on line 12:

line 21 of the federal Schedule

market value of your assets immediately

1116 for the subnational level

before the sale,

1 Because your Minnesota taxable

of a foreign country other

income for 2000 was a negative

• you included the gain from the sale in

than Canada . . . . . . . . . . . . . .

number, you should have filled

your federal adjusted gross income on

in zero on line 6 of your 2000

2 Foreign taxes paid from

line 33 of your federal Form 1040, and

Form M1. For purposes of

line 9 of the Schedule 1116 . .

• you applied the proceeds from the sale of

this step, you will need to

the property to paying off the mortgage,

3 Subtract step 2 from step 1 . .

compute the actual negative

contract for deed, or lien on the prop-

amount. Fill in that amount

4 Amount of tax you paid to a

erty.

here, but show it as a positive

subnational level of a foreign

If you meet all of the requirements, follow

number . . . . . . . . . . . . . . . . . .

country, other than Canada,

the steps below:

on income you received while

2 Amount from line 6 of your

a Minnesota resident . . . . . . .

1 Amount of your debts imme-

2000 Schedule M1M . . . . . . . .

diately before the sale . . . . . . .

5 Amount from step 3 or step 4,

3 Amount from line 7 of your

whichever is less. Also fill in

2 Amount of debt forgiveness

2000 Schedule M1M . . . . . . . .

this result on line 7 of your

that you were permitted to

4 Add step 2 and step 3 . . . . . . .

Schedule M1M . . . . . . . . . . . .

exclude from your income

when you filled out your

5 Fill in the result from step 1

Form 1040 . . . . . . . . . . . . . . . .

or step 4, whichever is less.

Also fill in this result on

3 Subtract step 2 from step 1 . .

line 12 of Schedule M1M . . . .

4 Fair market value of your

assets immediately before

the sale . . . . . . . . . . . . . . . . . . .

5 Subtract step 4 from step 3 . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1