Instructions For Completing Form F-1156z - Florida Enterprise Zone Jobs Credit Certificate Of Eligibility For Corporate Income Tax - Florida Department Of Revenue

ADVERTISEMENT

F-1156ZN

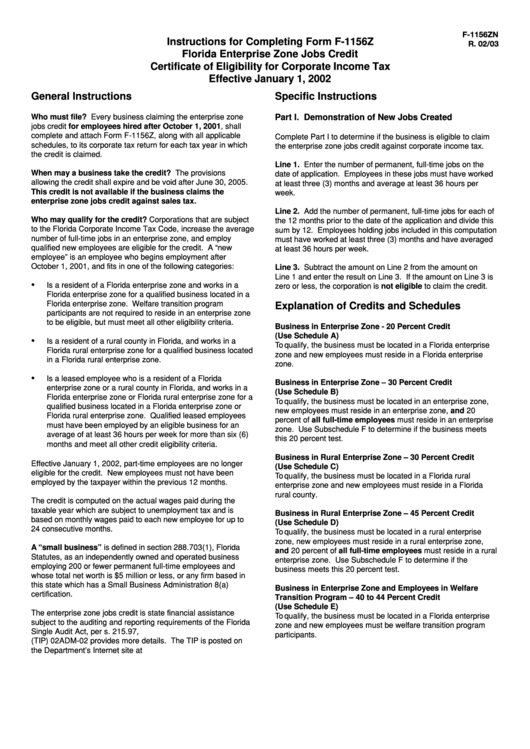

Instructions for Completing Form F-1156Z

R. 02/03

Florida Enterprise Zone Jobs Credit

Certificate of Eligibility for Corporate Income Tax

Effective January 1, 2002

General Instructions

Specific Instructions

Who must file? Every business claiming the enterprise zone

Part I. Demonstration of New Jobs Created

jobs credit for employees hired after October 1, 2001, shall

complete and attach Form F-1156Z, along with all applicable

Complete Part I to determine if the business is eligible to claim

schedules, to its corporate tax return for each tax year in which

the enterprise zone jobs credit against corporate income tax.

the credit is claimed.

Line 1. Enter the number of permanent, full-time jobs on the

When may a business take the credit? The provisions

date of application. Employees in these jobs must have worked

allowing the credit shall expire and be void after June 30, 2005.

at least three (3) months and average at least 36 hours per

This credit is not available if the business claims the

week.

enterprise zone jobs credit against sales tax.

Line 2. Add the number of permanent, full-time jobs for each of

Who may qualify for the credit? Corporations that are subject

the 12 months prior to the date of the application and divide this

to the Florida Corporate Income Tax Code, increase the average

sum by 12. Employees holding jobs included in this computation

number of full-time jobs in an enterprise zone, and employ

must have worked at least three (3) months and have averaged

qualified new employees are eligible for the credit. A “new

at least 36 hours per week.

employee” is an employee who begins employment after

October 1, 2001, and fits in one of the following categories:

Line 3. Subtract the amount on Line 2 from the amount on

Line 1 and enter the result on Line 3. If the amount on Line 3 is

•

Is a resident of a Florida enterprise zone and works in a

zero or less, the corporation is not eligible to claim the credit.

Florida enterprise zone for a qualified business located in a

Florida enterprise zone. Welfare transition program

Explanation of Credits and Schedules

participants are not required to reside in an enterprise zone

to be eligible, but must meet all other eligibility criteria.

Business in Enterprise Zone - 20 Percent Credit

(Use Schedule A)

•

Is a resident of a rural county in Florida, and works in a

To qualify, the business must be located in a Florida enterprise

Florida rural enterprise zone for a qualified business located

zone and new employees must reside in a Florida enterprise

in a Florida rural enterprise zone.

zone.

•

Is a leased employee who is a resident of a Florida

Business in Enterprise Zone – 30 Percent Credit

enterprise zone or a rural county in Florida, and works in a

(Use Schedule B)

Florida enterprise zone or Florida rural enterprise zone for a

To qualify, the business must be located in an enterprise zone,

qualified business located in a Florida enterprise zone or

new employees must reside in an enterprise zone, and 20

Florida rural enterprise zone. Qualified leased employees

percent of all full-time employees must reside in an enterprise

must have been employed by an eligible business for an

zone. Use Subschedule F to determine if the business meets

average of at least 36 hours per week for more than six (6)

this 20 percent test.

months and meet all other credit eligibility criteria.

Business in Rural Enterprise Zone – 30 Percent Credit

Effective January 1, 2002, part-time employees are no longer

(Use Schedule C)

eligible for the credit. New employees must not have been

To qualify, the business must be located in a Florida rural

employed by the taxpayer within the previous 12 months.

enterprise zone and new employees must reside in a Florida

rural county.

The credit is computed on the actual wages paid during the

taxable year which are subject to unemployment tax and is

Business in Rural Enterprise Zone – 45 Percent Credit

based on monthly wages paid to each new employee for up to

(Use Schedule D)

24 consecutive months.

To qualify, the business must be located in a rural enterprise

zone, new employees must reside in a rural enterprise zone,

A “small business” is defined in section 288.703(1), Florida

and 20 percent of all full-time employees must reside in a rural

Statutes, as an independently owned and operated business

enterprise zone. Use Subschedule F to determine if the

employing 200 or fewer permanent full-time employees and

business meets this 20 percent test.

whose total net worth is $5 million or less, or any firm based in

this state which has a Small Business Administration 8(a)

Business in Enterprise Zone and Employees in Welfare

certification.

Transition Program – 40 to 44 Percent Credit

(Use Schedule E)

The enterprise zone jobs credit is state financial assistance

To qualify, the business must be located in a Florida enterprise

subject to the auditing and reporting requirements of the Florida

zone and new employees must be welfare transition program

Single Audit Act, per s. 215.97, F.S. Tax Information Publication

participants.

(TIP) 02ADM-02 provides more details. The TIP is posted on

the Department’s Internet site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2