Tax Incentives Application - Puerto Rico Department Of Economic Development And Commerce Page 2

ADVERTISEMENT

If the response is in the affirmative, please provide a brief explanation of the reasons for the investigation, and its

current status or eventual result:

F. Provide the applicable documents specified in Annex A to this Application.

G. If this Application is for a Renegotiation, please provide the information required under Section 13(b)(1)(A) of

the Act as an attachment to this Application.

Section II. Information on Applicant’s Proposed Exempted Business

□ Manufacturing

A. Business Type:

□ Manufacturing Support Services

□ Strategic Projects

□ Other (Please Specify) ______________________________

B. Applicable Sections under the Act

1. Specify Section(s) of the Act under which tax incentives are requested _______________________________

2. Specify Section(s) of the Act under which the special tax rate is requested ___________________________

C. Provide a description of each of the proposed Exempted Businesses to be conducted in accordance with the Act.

□ New

□ Expansion

□ Reopening

D. Business classification:

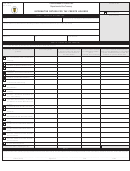

E. List of Products, Services or Activities for which the Tax Incentives are requested:

Current

12-Month Projection

Product, Service

3

Units/Year

Sales Value

Units/Year

Sales Value

NAICS

or Activity

F. Description of manufacturing process of products, services, or activities to be performed by Applicant. Include

final use of product or service. (Provide attachment if necessary).

G. Employees and Payroll

Current

12-Month Projection

Classification

Amount

Payroll

Amount

Payroll

Production/ Service

Supervision

Administration

3

North American Industry Classification System. Find your code here:

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9