General Instructions For Schedule Ct (Form Os-114) - Application For Connecticut/new York State Simplified Sales And Use Tax Reporting

ADVERTISEMENT

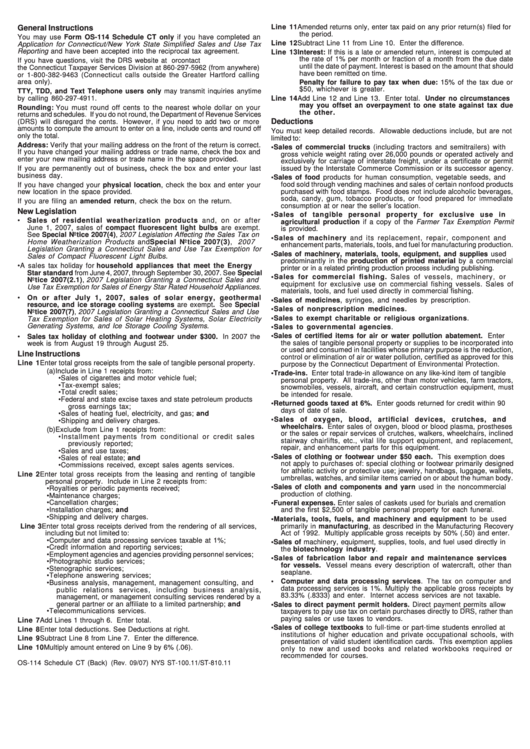

Line 11 Amended returns only, enter tax paid on any prior return(s) filed for

General Instructions

the period.

You may use Form OS-114 Schedule CT only if you have completed an

Line 12 Subtract Line 11 from Line 10. Enter the difference.

Application for Connecticut/New York State Simplified Sales and Use Tax

Reporting and have been accepted into the reciprocal tax agreement.

Line 13 Interest: If this is a late or amended return, interest is computed at

the rate of 1% per month or fraction of a month from the due date

If you have questions, visit the DRS website at or contact

until the date of payment. Interest is based on the amount that should

the Connecticut Taxpayer Services Division at 860-297-5962 (from anywhere)

have been remitted on time.

or 1-800-382-9463 (Connecticut calls outside the Greater Hartford calling

area only).

Penalty for failure to pay tax when due: 15% of the tax due or

$50, whichever is greater.

TTY, TDD, and Text Telephone users only may transmit inquiries anytime

by calling 860-297-4911.

Line 14 Add Line 12 and Line 13. Enter total. Under no circumstances

may you offset an overpayment to one state against tax due

Rounding: You must round off cents to the nearest whole dollar on your

the other.

returns and schedules. If you do not round, the Department of Revenue Services

Deductions

(DRS) will disregard the cents. However, if you need to add two or more

amounts to compute the amount to enter on a line, include cents and round off

You must keep detailed records. Allowable deductions include, but are not

only the total.

limited to:

Address: Verify that your mailing address on the front of the return is correct.

•

Sales of commercial trucks (including tractors and semitrailers) with

If you have changed your mailing address or trade name, check the box and

gross vehicle weight rating over 26,000 pounds or operated actively and

enter your new mailing address or trade name in the space provided.

exclusively for carriage of interstate freight, under a certificate or permit

If you are permanently out of business, check the box and enter your last

issued by the Interstate Commerce Commission or its successor agency.

business day.

•

Sales of food products for human consumption, vegetable seeds, and

If you have changed your physical location, check the box and enter your

food sold through vending machines and sales of certain nonfood products

purchased with food stamps. Food does not include alcoholic beverages,

new location in the space provided.

soda, candy, gum, tobacco products, or food prepared for immediate

If you are filing an amended return, check the box on the return.

consumption at or near the seller’s location.

New Legislation

•

Sales of tangible personal property for exclusive use in

•

Sales of residential weatherization products and, on or after

agricultural production if a copy of the Farmer Tax Exemption Permit

June 1, 2007, sales of compact fluorescent light bulbs are exempt.

is provided.

See Special Notice 2007(4), 2007 Legislation Affecting the Sales Tax on

•

Sales of machinery and its replacement, repair, component and

Home Weatherization Products and Special Notice 2007(3), 2007

enhancement parts, materials, tools, and fuel for manufacturing production.

Legislation Granting a Connecticut Sales and Use Tax Exemption for

•

Sales of machinery, materials, tools, equipment, and supplies used

Sales of Compact Fluorescent Light Bulbs.

predominantly in the production of printed material by a commercial

•

A sales tax holiday for household appliances that meet the Energy

printer or in a related printing production process including publishing.

Star standard from June 4, 2007, through September 30, 2007. See Special

•

Sales for commercial fishing. Sales of vessels, machinery, or

Notice 2007(2.1), 2007 Legislation Granting a Connecticut Sales and

equipment for exclusive use on commercial fishing vessels. Sales of

Use Tax Exemption for Sales of Energy Star Rated Household Appliances.

materials, tools, and fuel used directly in commercial fishing.

•

On or after July 1, 2007, sales of solar energy, geothermal

•

Sales of medicines, syringes, and needles by prescription.

resource, and ice storage cooling systems are exempt. See Special

•

Sales of nonprescription medicines.

Notice 2007(7), 2007 Legislation Granting a Connecticut Sales and Use

•

Sales to exempt charitable or religious organizations.

Tax Exemption for Sales of Solar Heating Systems, Solar Electricity

Generating Systems, and Ice Storage Cooling Systems.

•

Sales to governmental agencies.

•

Sales of certified items for air or water pollution abatement. Enter

•

Sales tax holiday of clothing and footwear under $300. In 2007 the

the sales of tangible personal property or supplies to be incorporated into

week is from August 19 through August 25.

or used and consumed in facilities whose primary purpose is the reduction,

Line Instructions

control or elimination of air or water pollution, certified as approved for this

Line 1 Enter total gross receipts from the sale of tangible personal property.

purpose by the Connecticut Department of Environmental Protection.

(a) Include in Line 1 receipts from:

•

Trade-ins. Enter total trade-in allowance on any like-kind item of tangible

•

Sales of cigarettes and motor vehicle fuel;

personal property. All trade-ins, other than motor vehicles, farm tractors,

•

Tax-exempt sales;

snowmobiles, vessels, aircraft, and certain construction equipment, must

•

Total credit sales;

be intended for resale.

•

Federal and state excise taxes and state petroleum products

•

Returned goods taxed at 6%. Enter goods returned for credit within 90

gross earnings tax;

days of date of sale.

•

Sales of heating fuel, electricity, and gas; and

•

Sales of oxygen, blood, artificial devices, crutches, and

•

Shipping and delivery charges.

wheelchairs. Enter sales of oxygen, blood or blood plasma, prostheses

(b) Exclude from Line 1 receipts from:

or the sales or repair services of crutches, walkers, wheelchairs, inclined

• Installment payments from conditional or credit sales

stairway chairlifts, etc., vital life support equipment, and replacement,

previously reported;

repair, and enhancement parts for this equipment.

• Sales and use taxes;

•

Sales of clothing or footwear under $50 each. This exemption does

• Sales of real estate; and

not apply to purchases of: special clothing or footwear primarily designed

• Commissions received, except sales agents services.

for athletic activity or protective use; jewelry, handbags, luggage, wallets,

Line 2 Enter total gross receipts from the leasing and renting of tangible

umbrellas, watches, and similar items carried on or about the human body.

personal property. Include in Line 2 receipts from:

•

Sales of cloth and components and yarn used in the noncommercial

•

Royalties or periodic payments received;

production of clothing.

•

Maintenance charges;

•

Cancellation charges;

•

Funeral expenses. Enter sales of caskets used for burials and cremation

•

Installation charges; and

and the first $2,500 of tangible personal property for each funeral.

•

Shipping and delivery charges.

•

Materials, tools, fuels, and machinery and equipment to be used

Line 3 Enter total gross receipts derived from the rendering of all services,

primarily in manufacturing, as described in the Manufacturing Recovery

including but not limited to:

Act of 1992. Multiply applicable gross receipts by 50% (.50) and enter.

•

Computer and data processing services taxable at 1%;

•

Sales of machinery, equipment, supplies, tools, and fuel used directly in

•

Credit information and reporting services;

the biotechnology industry.

•

Employment agencies and agencies providing personnel services;

•

Sales of fabrication labor and repair and maintenance services

•

Photographic studio services;

for vessels. Vessel means every description of watercraft, other than

•

Stenographic services;

seaplane.

•

Telephone answering services;

•

Computer and data processing services. The tax on computer and

•

Business analysis, management, management consulting, and

data processing services is 1%. Multiply the applicable gross receipts by

public relations services, including business analysis,

83.33% (.8333) and enter. Internet access services are not taxable.

management, or management consulting services rendered by a

general partner or an affiliate to a limited partnership; and

•

Sales to direct payment permit holders. Direct payment permits allow

•

Telecommunications services.

taxpayers to pay use tax on certain purchases directly to DRS, rather than

paying sales or use taxes to vendors.

Line 7 Add Lines 1 through 6. Enter total.

•

Sales of college textbooks to full-time or part-time students enrolled at

Line 8 Enter total deductions. See Deductions at right.

institutions of higher education and private occupational schools, with

Line 9 Subtract Line 8 from Line 7. Enter the difference.

presentation of valid student identification cards. This exemption applies

Line 10 Multiply amount entered on Line 9 by 6% (.06).

only to new and used books and related workbooks required or

recommended for courses.

OS-114 Schedule CT (Back) (Rev. 09/07) NYS ST-100.11/ST-810.11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1