Form 50-255 - City Report Of Property Value - Short Form - 2004

ADVERTISEMENT

50-255

(Rev. 7-04/13)

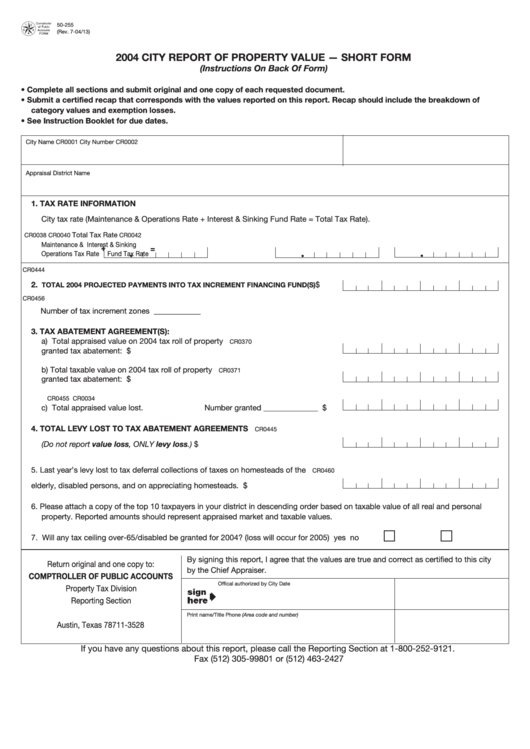

2004 CITY REPORT OF PROPERTY VALUE — SHORT FORM

(Instructions On Back Of Form)

• Complete all sections and submit original and one copy of each requested document.

• Submit a certified recap that corresponds with the values reported on this report. Recap should include the breakdown of

category values and exemption losses.

• See Instruction Booklet for due dates.

City Name

CR0001

City Number

CR0002

Appraisal District Name

1. TAX RATE INFORMATION

City tax rate (Maintenance & Operations Rate + Interest & Sinking Fund Rate = Total Tax Rate).

Total Tax Rate

CR0038

CR0040

CR0042

Maintenance &

Interest & Sinking

+

=

Operations Tax Rate

Fund Tax Rate

CR0444

2.

$

TOTAL 2004 PROJECTED PAYMENTS INTO TAX INCREMENT FINANCING FUND(S) .......

CR0456

Number of tax increment zones ____________

3. TAX ABATEMENT AGREEMENT(S):

a) Total appraised value on 2004 tax roll of property

CR0370

granted tax abatement: ......................................................................................... $

b) Total taxable value on 2004 tax roll of property

CR0371

granted tax abatement: ......................................................................................... $

CR0455

CR0034

c) Total appraised value lost.

Number granted ______________

$

4. TOTAL LEVY LOST TO TAX ABATEMENT AGREEMENTS

CR0445

(Do not report value loss, ONLY levy loss.) ............................................................. $

5. Last year’s levy lost to tax deferral collections of taxes on homesteads of the

CR0460

elderly, disabled persons, and on appreciating homesteads. .................................... $

6. Please attach a copy of the top 10 taxpayers in your district in descending order based on taxable value of all real and personal

property. Reported amounts should represent appraised market and taxable values.

7. Will any tax ceiling over-65/disabled be granted for 2004? (loss will occur for 2005)

yes

no

By signing this report, I agree that the values are true and correct as certified to this city

Return original and one copy to:

by the Chief Appraiser.

COMPTROLLER OF PUBLIC ACCOUNTS

Offical authorized by City

Date

Property Tax Division

Reporting Section

P.O. Box 13528

Print name/Title

Phone (Area code and number)

Austin, Texas 78711-3528

If you have any questions about this report, please call the Reporting Section at 1-800-252-9121.

Fax (512) 305-99801 or (512) 463-2427

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2