Instructions For Form 541-Qft - California Income Tax Return For Qualified Funeral Trusts (Qfts) - 2010

ADVERTISEMENT

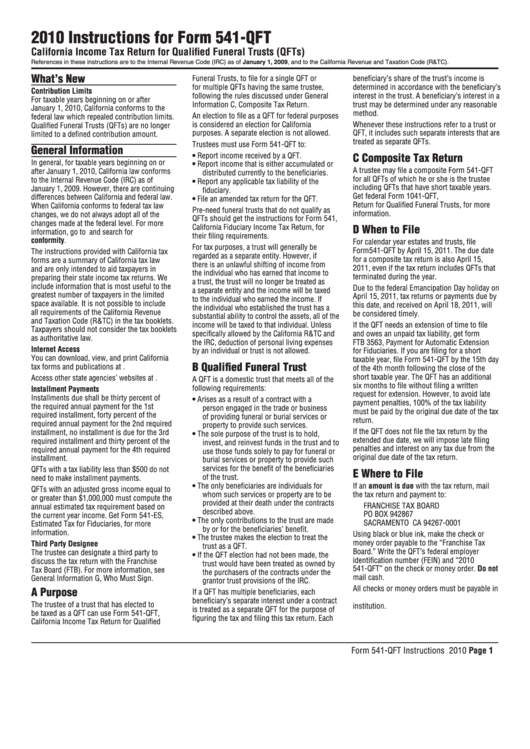

2010 Instructions for Form 541-QFT

California Income Tax Return for Qualified Funeral Trusts (QFTs)

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

What’s New

Funeral Trusts, to file for a single QFT or

beneficiary’s share of the trust’s income is

for multiple QFTs having the same trustee,

determined in accordance with the beneficiary’s

Contribution Limits

following the rules discussed under General

interest in the trust . A beneficiary’s interest in a

For taxable years beginning on or after

Information C, Composite Tax Return .

trust may be determined under any reasonable

January 1, 2010, California conforms to the

method .

An election to file as a QFT for federal purposes

federal law which repealed contribution limits .

is considered an election for California

Whenever these instructions refer to a trust or

Qualified Funeral Trusts (QFTs) are no longer

purposes . A separate election is not allowed .

QFT, it includes such separate interests that are

limited to a defined contribution amount .

treated as separate QFTs .

Trustees must use Form 541-QFT to:

General Information

• Report income received by a QFT .

C Composite Tax Return

In general, for taxable years beginning on or

• Report income that is either accumulated or

A trustee may file a composite Form 541-QFT

after January 1, 2010, California law conforms

distributed currently to the beneficiaries .

for all QFTs of which he or she is the trustee

to the Internal Revenue Code (IRC) as of

• Report any applicable tax liability of the

including QFTs that have short taxable years .

January 1, 2009 . However, there are continuing

fiduciary .

Get federal Form 1041-QFT, U .S . Income Tax

differences between California and federal law .

• File an amended tax return for the QFT .

Return for Qualified Funeral Trusts, for more

When California conforms to federal tax law

Pre-need funeral trusts that do not qualify as

information .

changes, we do not always adopt all of the

QFTs should get the instructions for Form 541,

changes made at the federal level . For more

California Fiduciary Income Tax Return, for

D When to File

information, go to ftb.ca.gov and search for

their filing requirements .

conformity .

For calendar year estates and trusts, file

For tax purposes, a trust will generally be

Form 541-QFT by April 15, 2011 . The due date

The instructions provided with California tax

regarded as a separate entity . However, if

for a composite tax return is also April 15,

forms are a summary of California tax law

there is an unlawful shifting of income from

2011, even if the tax return includes QFTs that

and are only intended to aid taxpayers in

the individual who has earned that income to

terminated during the year .

preparing their state income tax returns . We

a trust, the trust will no longer be treated as

include information that is most useful to the

Due to the federal Emancipation Day holiday on

a separate entity and the income will be taxed

greatest number of taxpayers in the limited

April 15, 2011, tax returns or payments due by

to the individual who earned the income . If

space available . It is not possible to include

this date, and received on April 18, 2011, will

the individual who established the trust has a

all requirements of the California Revenue

be considered timely .

substantial ability to control the assets, all of the

and Taxation Code (R&TC) in the tax booklets .

income will be taxed to that individual . Unless

If the QFT needs an extension of time to file

Taxpayers should not consider the tax booklets

specifically allowed by the California R&TC and

and owes an unpaid tax liability, get form

as authoritative law .

the IRC, deduction of personal living expenses

FTB 3563, Payment for Automatic Extension

Internet Access

by an individual or trust is not allowed .

for Fiduciaries . If you are filing for a short

You can download, view, and print California

taxable year, file Form 541-QFT by the 15th day

B Qualified Funeral Trust

tax forms and publications at ftb.ca.gov .

of the 4th month following the close of the

short taxable year . The QFT has an additional

Access other state agencies’ websites at ca.gov .

A QFT is a domestic trust that meets all of the

six months to file without filing a written

following requirements:

Installment Payments

request for extension . However, to avoid late

Installments due shall be thirty percent of

• Arises as a result of a contract with a

payment penalties, 100% of the tax liability

the required annual payment for the 1st

person engaged in the trade or business

must be paid by the original due date of the tax

required installment, forty percent of the

of providing funeral or burial services or

return .

required annual payment for the 2nd required

property to provide such services .

If the QFT does not file the tax return by the

installment, no installment is due for the 3rd

• The sole purpose of the trust is to hold,

extended due date, we will impose late filing

required installment and thirty percent of the

invest, and reinvest funds in the trust and to

penalties and interest on any tax due from the

required annual payment for the 4th required

use those funds solely to pay for funeral or

original due date of the tax return .

installment .

burial services or property to provide such

services for the benefit of the beneficiaries

QFTs with a tax liability less than $500 do not

E Where to File

of the trust .

need to make installment payments .

• The only beneficiaries are individuals for

If an amount is due with the tax return, mail

QFTs with an adjusted gross income equal to

whom such services or property are to be

the tax return and payment to:

or greater than $1,000,000 must compute the

provided at their death under the contracts

FRANCHISE TAX BOARD

annual estimated tax requirement based on

described above .

PO BOX 942867

the current year income . Get Form 541-ES,

• The only contributions to the trust are made

SACRAMENTO CA 94267-0001

Estimated Tax for Fiduciaries, for more

by or for the beneficiaries’ benefit .

information .

Using black or blue ink, make the check or

• The trustee makes the election to treat the

money order payable to the “Franchise Tax

Third Party Designee

trust as a QFT .

Board .” Write the QFT’s federal employer

The trustee can designate a third party to

• If the QFT election had not been made, the

identification number (FEIN) and “2010

discuss the tax return with the Franchise

trust would have been treated as owned by

541-QFT” on the check or money order . Do not

Tax Board (FTB) . For more information, see

the purchasers of the contracts under the

mail cash .

General Information G, Who Must Sign .

grantor trust provisions of the IRC .

All checks or money orders must be payable in

A Purpose

If a QFT has multiple beneficiaries, each

U .S . dollars and drawn against a U .S . financial

beneficiary’s separate interest under a contract

The trustee of a trust that has elected to

institution .

is treated as a separate QFT for the purpose of

be taxed as a QFT can use Form 541-QFT,

figuring the tax and filing this tax return . Each

California Income Tax Return for Qualified

Form 541-QFT Instructions 2010 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4