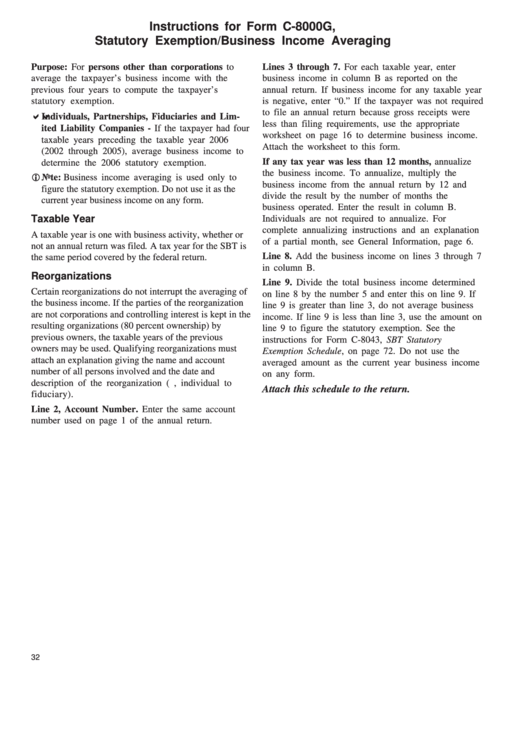

Instructions For Form C-8000g, Statutory Exemption/business Income Averaging

ADVERTISEMENT

Instructions for Form C-8000G,

Statutory Exemption/Business Income Averaging

Purpose: For persons other than corporations to

Lines 3 through 7. For each taxable year, enter

average the taxpayer’s business income with the

business income in column B as reported on the

previous four years to compute the taxpayer’s

annual return. If business income for any taxable year

statutory exemption.

is negative, enter “0.” If the taxpayer was not required

to file an annual return because gross receipts were

Individuals, Partnerships, Fiduciaries and Lim-

less than filing requirements, use the appropriate

ited Liability Companies - If the taxpayer had four

worksheet on page 16 to determine business income.

taxable years preceding the taxable year 2006

Attach the worksheet to this form.

(2002 through 2005), average business income to

If any tax year was less than 12 months, annualize

determine the 2006 statutory exemption.

the business income. To annualize, multiply the

Note: Business income averaging is used only to

business income from the annual return by 12 and

figure the statutory exemption. Do not use it as the

divide the result by the number of months the

current year business income on any form.

business operated. Enter the result in column B.

Taxable Year

Individuals are not required to annualize. For

complete annualizing instructions and an explanation

A taxable year is one with business activity, whether or

of a partial month, see General Information, page 6.

not an annual return was filed. A tax year for the SBT is

Line 8. Add the business income on lines 3 through 7

the same period covered by the federal return.

in column B.

Reorganizations

Line 9. Divide the total business income determined

Certain reorganizations do not interrupt the averaging of

on line 8 by the number 5 and enter this on line 9. If

the business income. If the parties of the reorganization

line 9 is greater than line 3, do not average business

are not corporations and controlling interest is kept in the

income. If line 9 is less than line 3, use the amount on

resulting organizations (80 percent ownership) by

line 9 to figure the statutory exemption. See the

previous owners, the taxable years of the previous

instructions for Form C-8043, SBT Statutory

owners may be used. Qualifying reorganizations must

Exemption Schedule, on page 72. Do not use the

attach an explanation giving the name and account

averaged amount as the current year business income

number of all persons involved and the date and

on any form.

description of the reorganization (e.g., individual to

Attach this schedule to the return.

fiduciary).

Line 2, Account Number. Enter the same account

number used on page 1 of the annual return.

32

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1