Instructions For Form C-8000s, Reductions To Adjusted Tax Base

ADVERTISEMENT

Instructions for Form C-8000S,

Reductions to Adjusted Tax Base

Purpose: To allow filers to reduce adjusted tax base

Form C-8000, line 42, and indicate the Gross Receipts

(ATB) by excess compensation or gross receipts.

Reduction method on line 41.

If either of the following applies, taxpayers may

Note: Adjusted gross receipts for this purpose means

reduce their ATB before figuring their tax.

gross receipts, apportioned for companies doing

• Compensation Reduction: Total compensation

business outside of Michigan, plus recapture of Capital

from Form C-8000, SBT Annual Return, line 16,

Acquisition Deduction.

comprises more than 63 percent of tax base.

Important: For further information about adjusted

• Gross Receipts Reduction: ATB from Form

gross receipts, see Notice to Single Business Tax

C-8000, line 40, is greater than 50 percent of gross

Filers, on page 77.

receipts plus recapture of Capital Acquisition

Lines 9-15. Compute 50 percent of the apportioned

Deduction (CAD).

gross receipts plus recapture of the CAD. Reduce

Note: Taxpayers taking a compensation reduction

ATB by the amount that is in excess of this

must also reduce their Investment Tax Credit (ITC).

calculation.

Any net recapture of capital investment is not

Note: Taking a gross receipts reduction prohibits

reduced and must be reported on Form C-8000ITC,

taxpayers from claiming an ITC. Thus, for some

SBT Investment Tax Credit. Taxpayers taking a

taxpayers it may be more advantageous not to take a

gross receipts reduction are not eligible for an ITC

gross receipts reduction and claim an ITC. To

and recapture of ITC is not required.

determine if this situation applies to you, complete the

Important: For some taxpayers eligible for an ITC,

Worksheet on this page.

it may be more advantageous not to take a reduction

PART 3: Summary

in their ATB and instead take a full ITC. Complete

Line 16. Because of the interaction between different

the Worksheet on this page to determine the most

ATB reduction methods and the ITC calculation, it may

favorable method.

be more advantageous for some taxpayers not to take a

Carry all percentages to six decimal places. Do not round

reduction in their ATB and take a full ITC. Complete the

percentages. For example 24.154256 percent becomes

Worksheet on this page to determine which method

24.1542 percent (.241542).

provides the greatest reduction to your tax liability.

Line-By-Line Instructions

Taxpayers may choose only one method to reduce their

Lines not listed are explained on the form.

ATB. To claim a reduction, follow instructions on line 4

Line 2, Account Number. Enter the same account

of the Worksheet.

number used on page 1 of the annual return.

Attach this schedule to the return.

PART 1: Compensation Reduction

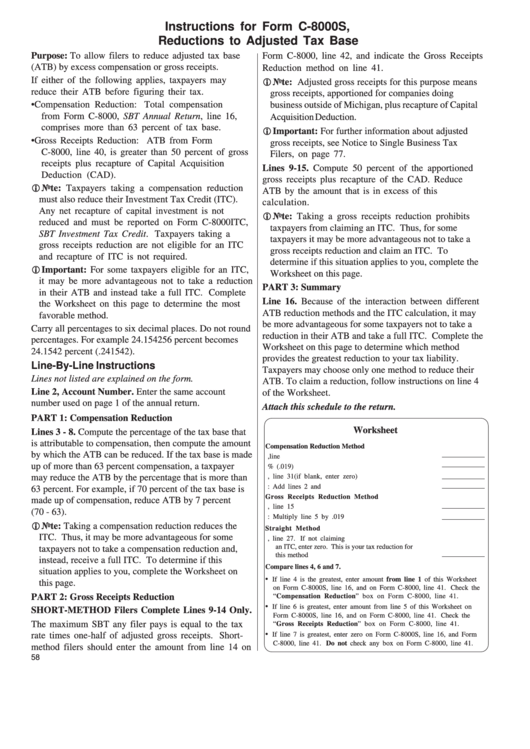

Worksheet

Lines 3 - 8. Compute the percentage of the tax base that

is attributable to compensation, then compute the amount

Compensation Reduction Method

by which the ATB can be reduced. If the tax base is made

1. Amount from C-8000S, line 8 ........................................

up of more than 63 percent compensation, a taxpayer

2. Multiply line 1 by 1.9% (.019) .......................................

may reduce the ATB by the percentage that is more than

3. Amount from C-8000ITC, line 31(if blank, enter zero)

4. Tax reduction for this method: Add lines 2 and 3 ........

63 percent. For example, if 70 percent of the tax base is

Gross Receipts Reduction Method

made up of compensation, reduce ATB by 7 percent

5. Amount from C-8000S, line 15 ......................................

(70 - 63).

6. Tax reduction for this method: Multiply line 5 by .019

Note: Taking a compensation reduction reduces the

Straight Method

ITC. Thus, it may be more advantageous for some

7. Amount from C-8000ITC, line 27. If not claiming

an ITC, enter zero. This is your tax reduction for

taxpayers not to take a compensation reduction and,

this method ..........................................................................

instead, receive a full ITC. To determine if this

Compare lines 4, 6 and 7.

situation applies to you, complete the Worksheet on

•

If line 4 is the greatest, enter amount from line 1 of this Worksheet

this page.

on Form C-8000S, line 16, and on Form C-8000, line 41. Check the

PART 2: Gross Receipts Reduction

“Compensation Reduction” box on Form C-8000, line 41.

•

If line 6 is greatest, enter amount from line 5 of this Worksheet on

SHORT-METHOD Filers Complete Lines 9-14 Only.

Form C-8000S, line 16, and on Form C-8000, line 41. Check the

The maximum SBT any filer pays is equal to the tax

“Gross Receipts Reduction” box on Form C-8000, line 41.

•

If line 7 is greatest, enter zero on Form C-8000S, line 16, and Form

rate times one-half of adjusted gross receipts. Short-

C-8000, line 41. Do not check any box on Form C-8000, line 41.

method filers should enter the amount from line 14 on

58

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1