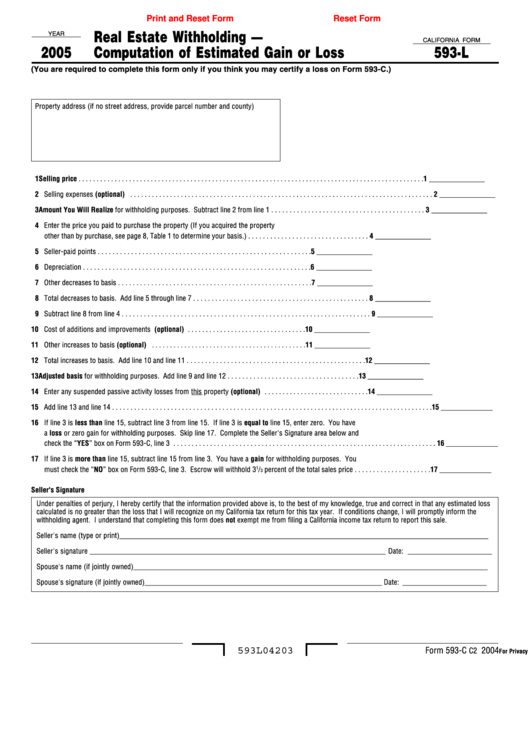

Print and Reset Form

Reset Form

YEAR

Real Estate Withholding —

CALIFORNIA FORM

2005

Computation of Estimated Gain or Loss

593-L

(You are required to complete this form only if you think you may certify a loss on Form 593-C.)

Property address (if no street address, provide parcel number and county)

1 Selling price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 _______________

2 Selling expenses (optional) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 _______________

3 Amount You Will Realize for withholding purposes. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 _______________

4 Enter the price you paid to purchase the property (If you acquired the property

other than by purchase, see page 8, Table 1 to determine your basis.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 _______________

5 Seller-paid points . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 _______________

6 Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 _______________

7 Other decreases to basis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 _______________

8 Total decreases to basis. Add line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 _______________

9 Subtract line 8 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 _______________

10 Cost of additions and improvements (optional) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 _______________

11 Other increases to basis (optional) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 _______________

12 Total increases to basis. Add line 10 and line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 _______________

13 Adjusted basis for withholding purposes. Add line 9 and line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 _______________

14 Enter any suspended passive activity losses from this property (optional) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 _______________

15 Add line 13 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 ______________

16 If line 3 is less than line 15, subtract line 3 from line 15. If line 3 is equal to line 15, enter zero. You have

a loss or zero gain for withholding purposes. Skip line 17. Complete the Seller's Signature area below and

check the “YES” box on Form 593-C, line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 ______________

17 If line 3 is more than line 15, subtract line 15 from line 3. You have a gain for withholding purposes. You

must check the “NO” box on Form 593-C, line 3. Escrow will withhold 3

1

/

percent of the total sales price . . . . . . . . . . . . . . . . . . . . . 17 ______________

3

Seller's Signature

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct in that any estimated loss

calculated is no greater than the loss that I will recognize on my California tax return for this tax year. If conditions change, I will promptly inform the

withholding agent. I understand that completing this form does not exempt me from filing a California income tax return to report this sale.

Seller's name (type or print) _____________________________________________________________________________________________________

Seller's signature _________________________________________________________________________________ Date: _______________________

Spouse's name (if jointly owned) _________________________________________________________________________________________________

Spouse's signature (if jointly owned) _________________________________________________________________ Date: _______________________

593L04203

Form 593-C

2004

C2

For Privacy Act Notice, get form FTB 1131 (Individuals only).

1

1