MONTANA

RESET

AFCR

Rev 08 10

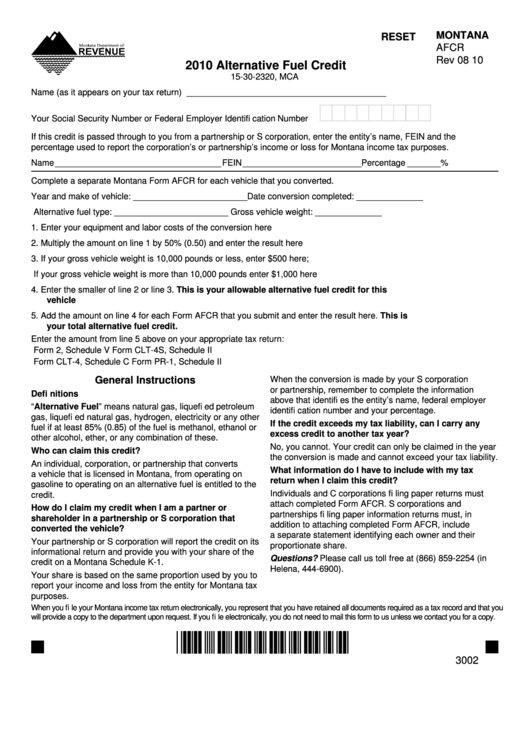

2010 Alternative Fuel Credit

15-30-2320, MCA

Name (as it appears on your tax return) __________________________________________

Your Social Security Number or Federal Employer Identifi cation Number

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and the

percentage used to report the corporation’s or partnership’s income or loss for Montana income tax purposes.

Name ___________________________________ FEIN _________________________ Percentage _______ %

Complete a separate Montana Form AFCR for each vehicle that you converted.

Year and make of vehicle: ________________________Date conversion completed: ______________

Alternative fuel type: ________________________

Gross vehicle weight: ______________

1. Enter your equipment and labor costs of the conversion here ........................................................... 1. _____________

2. Multiply the amount on line 1 by 50% (0.50) and enter the result here .............................................. 2. _____________

3. If your gross vehicle weight is 10,000 pounds or less, enter $500 here;

If your gross vehicle weight is more than 10,000 pounds enter $1,000 here ..................................... 3. _____________

4. Enter the smaller of line 2 or line 3. This is your allowable alternative fuel credit for this

vehicle ............................................................................................................................................... 4. _____________

5. Add the amount on line 4 for each Form AFCR that you submit and enter the result here. This is

your total alternative fuel credit. .................................................................................................... 5. _____________

Enter the amount from line 5 above on your appropriate tax return:

Form 2, Schedule V

Form CLT-4S, Schedule II

Form CLT-4, Schedule C

Form PR-1, Schedule II

General Instructions

When the conversion is made by your S corporation

or partnership, remember to complete the information

Defi nitions

above that identifi es the entity’s name, federal employer

“Alternative Fuel” means natural gas, liquefi ed petroleum

identifi cation number and your percentage.

gas, liquefi ed natural gas, hydrogen, electricity or any other

If the credit exceeds my tax liability, can I carry any

fuel if at least 85% (0.85) of the fuel is methanol, ethanol or

excess credit to another tax year?

other alcohol, ether, or any combination of these.

No, you cannot. Your credit can only be claimed in the year

Who can claim this credit?

the conversion is made and cannot exceed your tax liability.

An individual, corporation, or partnership that converts

What information do I have to include with my tax

a vehicle that is licensed in Montana, from operating on

return when I claim this credit?

gasoline to operating on an alternative fuel is entitled to the

Individuals and C corporations fi ling paper returns must

credit.

attach completed Form AFCR. S corporations and

How do I claim my credit when I am a partner or

partnerships fi ling paper information returns must, in

shareholder in a partnership or S corporation that

addition to attaching completed Form AFCR, include

converted the vehicle?

a separate statement identifying each owner and their

Your partnership or S corporation will report the credit on its

proportionate share.

informational return and provide you with your share of the

Questions? Please call us toll free at (866) 859-2254 (in

credit on a Montana Schedule K-1.

Helena, 444-6900).

Your share is based on the same proportion used by you to

report your income and loss from the entity for Montana tax

purposes.

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required as a tax record and that you

will provide a copy to the department upon request. If you fi le electronically, you do not need to mail this form to us unless we contact you for a copy.

*30020101*

3002

1

1