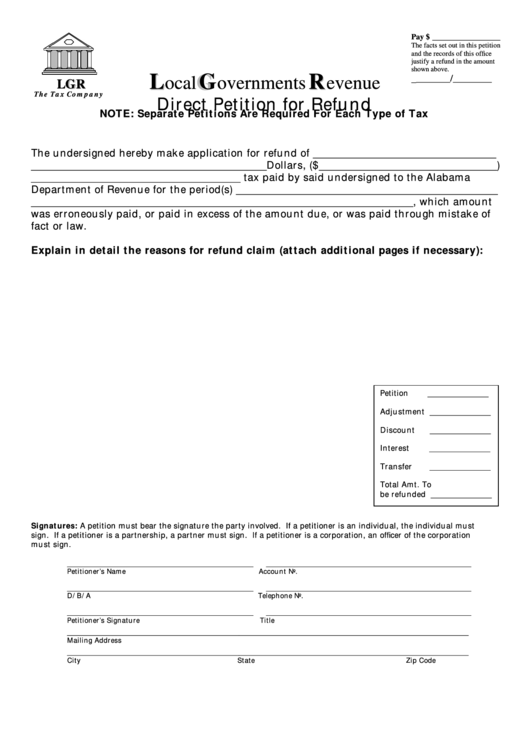

Form Local Governments Revenue Direct Petition For Refund - Alabama Department Of Revenue

ADVERTISEMENT

______________

Pay $

The facts set out in this petition

and the records of this office

justify a refund in the amount

shown above.

L

G

R

L

G

R

________/________

L

G

R

ocal

overnments

evenue

L

G

R

The Tax Company

Direct Petition for Refund

NOTE: Separate Petitions Are Required For Each Type of Tax

The undersigned hereby make application for refund of ___________________________________

_____________________________________________Dollars, ($__________________________________)

________________________________________ tax paid by said undersigned to the Alabama

Department of Revenue for the period(s) __________________________________________________

_________________________________________________________________________, which amount

was erroneously paid, or paid in excess of the amount due, or was paid through mistake of

fact or law.

Explain in detail the reasons for refund claim (attach additional pages if necessary):

Petition

_______________

Adjustment _______________

Discount

_______________

Interest

_______________

Transfer

_______________

Total Amt. To

be refunded _______________

Signatures: A petition must bear the signature the party involved. If a petitioner is an individual, the individual must

sign. If a petitioner is a partnership, a partner must sign. If a petitioner is a corporation, an officer of the corporation

must sign.

____________________________________________________

__________________________________________________________

Petitioner’s Name

Account No.

____________________________________________________

__________________________________________________________

D/B/A

Telephone No.

____________________________________________________

__________________________________________________________

Petitioner’s Signature

Title

__________________________________________________________________________________________________________________

Mailing Address

__________________________________________________________________________________________________________________

City

State

Zip Code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1