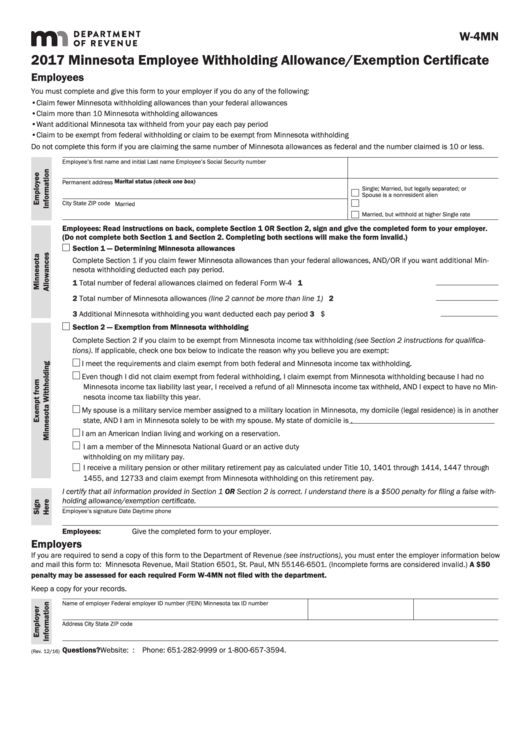

W-4MN

2017 Minnesota Employee Withholding Allowance/Exemption Certificate

Employees

You must complete and give this form to your employer if you do any of the following:

• Claim fewer Minnesota withholding allowances than your federal allowances

• Claim more than 10 Minnesota withholding allowances

• Want additional Minnesota tax withheld from your pay each pay period

• Claim to be exempt from federal withholding or claim to be exempt from Minnesota withholding

Do not complete this form if you are claiming the same number of Minnesota allowances as federal and the number claimed is 10 or less.

Employee’s first name and initial

Last name

Employee’s Social Security number

Marital status (check one box)

Permanent address

Single; Married, but legally separated; or

Spouse is a nonresident alien

City

State

ZIP code

Married

Married, but withhold at higher Single rate

Employees: Read instructions on back, complete Section 1 OR Section 2, sign and give the completed form to your employer.

(Do not complete both Section 1 and Section 2. Completing both sections will make the form invalid.)

Section 1 — Determining Minnesota allowances

Complete Section 1 if you claim fewer Minnesota allowances than your federal allowances, AND/OR if you want additional Min-

nesota withholding deducted each pay period.

1 Total number of federal allowances claimed on federal Form W-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total number of Minnesota allowances (line 2 cannot be more than line 1) . . . . . . . . . . . . . . . . . . . . . . . 2

3 Additional Minnesota withholding you want deducted each pay period . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $

Section 2 — Exemption from Minnesota withholding

Complete Section 2 if you claim to be exempt from Minnesota income tax withholding (see Section 2 instructions for qualifica-

tions). If applicable, check one box below to indicate the reason why you believe you are exempt:

I meet the requirements and claim exempt from both federal and Minnesota income tax withholding.

Even though I did not claim exempt from federal withholding, I claim exempt from Minnesota withholding because I had no

Minnesota income tax liability last year, I received a refund of all Minnesota income tax withheld, AND I expect to have no Min-

nesota income tax liability this year.

My spouse is a military service member assigned to a military location in Minnesota, my domicile (legal residence) is in another

state, AND I am in Minnesota solely to be with my spouse. My state of domicile is

.

I am an American Indian living and working on a reservation.

I am a member of the Minnesota National Guard or an active duty U.S. military member and claim exempt from Minnesota

withholding on my military pay.

I receive a military pension or other military retirement pay as calculated under Title 10, 1401 through 1414, 1447 through

1455, and 12733 and claim exempt from Minnesota withholding on this retirement pay.

I certify that all information provided in Section 1 OR Section 2 is correct. I understand there is a $500 penalty for filing a false with-

holding allowance/exemption certificate.

Employee’s signature

Date

Daytime phone

Employees: Give the completed form to your employer.

Employers

If you are required to send a copy of this form to the Department of Revenue (see instructions), you must enter the employer information below

and mail this form to: Minnesota Revenue, Mail Station 6501, St. Paul, MN 55146-6501. (Incomplete forms are considered invalid.) A $50

penalty may be assessed for each required Form W-4MN not filed with the department.

Keep a copy for your records.

Name of employer

Federal employer ID number (FEIN)

Minnesota tax ID number

Address

City

State

ZIP code

Questions?

Website: Email: withholding.tax@state.mn.us. Phone: 651-282-9999 or 1-800-657-3594.

(Rev. 12/16)

1

1 2

2 3

3