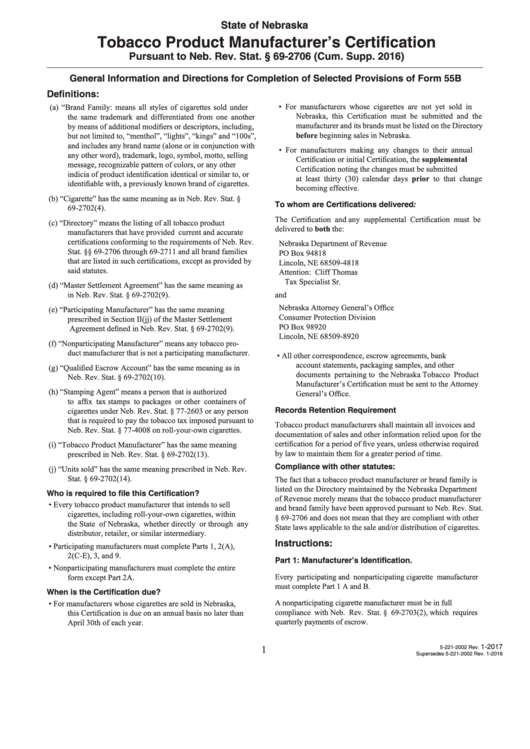

State of Nebraska

Tobacco Product Manufacturer’s Certification

Pursuant to Neb. Rev. Stat. § 69-2706 (Cum. Supp. 2016)

General Information and Directions for Completion of Selected Provisions of Form 55B

Definitions:

•

For manufacturers whose cigarettes are not yet sold in

(a) “Brand Family: means all styles of cigarettes sold under

Nebraska, this Certification must be submitted and the

the same trademark and differentiated from one another

manufacturer and its brands must be listed on the Directory

by means of additional modifiers or descriptors, including,

before beginning sales in Nebraska.

but not limited to, “menthol”, “lights”, “kings” and “100s”,

and includes any brand name (alone or in conjunction with

•

For manufacturers making any changes to their annual

any other word), trademark, logo, symbol, motto, selling

Certification or initial Certification, the supplemental

message, recognizable pattern of colors, or any other

Certification noting the changes must be submitted

indicia of product identification identical or similar to, or

at least thirty (30) calendar days prior to that change

identifiable with, a previously known brand of cigarettes.

becoming effective.

(b) “Cigarette” has the same meaning as in Neb. Rev. Stat. §

To whom are Certifications delivered:

69-2702(4).

The Certification and any supplemental Certification must be

(c) “Directory” means the listing of all tobacco product

delivered to both the:

manufacturers that have provided current and accurate

certifications conforming to the requirements of Neb. Rev.

Nebraska Department of Revenue

Stat. §§ 69-2706 through 69-2711 and all brand families

PO Box 94818

that are listed in such certifications, except as provided by

Lincoln, NE 68509-4818

said statutes.

Attention:

Cliff Thomas

Tax Specialist Sr.

(d) “Master Settlement Agreement” has the same meaning as

in Neb. Rev. Stat. § 69-2702(9).

and

Nebraska Attorney General’s Office

(e) “Participating Manufacturer” has the same meaning

Consumer Protection Division

prescribed in Section II(jj) of the Master Settlement

PO Box 98920

Agreement defined in Neb. Rev. Stat. § 69-2702(9).

Lincoln, NE 68509-8920

(f) “Nonparticipating Manufacturer” means any tobacco pro-

duct manufacturer that is not a participating manufacturer.

•

All other correspondence, escrow agreements, bank

account statements, packaging samples, and other

(g) “Qualified Escrow Account” has the same meaning as in

documents pertaining to the Nebraska Tobacco Product

Neb. Rev. Stat. § 69-2702(10).

Manufacturer’s Certification must be sent to the Attorney

(h) “Stamping Agent” means a person that is authorized

General’s Office.

to affix tax stamps to packages or other containers of

Records Retention Requirement

cigarettes under Neb. Rev. Stat. § 77-2603 or any person

that is required to pay the tobacco tax imposed pursuant to

Tobacco product manufacturers shall maintain all invoices and

Neb. Rev. Stat. § 77-4008 on roll-your-own cigarettes.

documentation of sales and other information relied upon for the

certification for a period of five years, unless otherwise required

(i) “Tobacco Product Manufacturer” has the same meaning

by law to maintain them for a greater period of time.

prescribed in Neb. Rev. Stat. § 69-2702(13).

Compliance with other statutes:

(j) “Units sold” has the same meaning prescribed in Neb. Rev.

Stat. § 69-2702(14).

The fact that a tobacco product manufacturer or brand family is

listed on the Directory maintained by the Nebraska Department

Who is required to file this Certification?

of Revenue merely means that the tobacco product manufacturer

•

Every tobacco product manufacturer that intends to sell

and brand family have been approved pursuant to Neb. Rev. Stat.

cigarettes, including roll-your-own cigarettes, within

§ 69-2706 and does not mean that they are compliant with other

the State of Nebraska, whether directly or through any

State laws applicable to the sale and/or distribution of cigarettes.

distributor, retailer, or similar intermediary.

Instructions:

•

Participating manufacturers must complete Parts 1, 2(A),

2(C-E), 3, and 9.

Part 1: Manufacturer’s Identification.

•

Nonparticipating manufacturers must complete the entire

Every participating and nonparticipating cigarette manufacturer

form except Part 2A.

must complete Part 1 A and B.

When is the Certification due?

A nonparticipating cigarette manufacturer must be in full

•

For manufacturers whose cigarettes are sold in Nebraska,

compliance with Neb. Rev. Stat. § 69-2703(2), which requires

this Certification is due on an annual basis no later than

quarterly payments of escrow.

April 30th of each year.

1

1-2017

5-221-2002 Rev.

Supersedes 5-221-2002 Rev. 1-2016

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10