Instructions For City Of Bellevue Business & Occupation Tax

ADVERTISEMENT

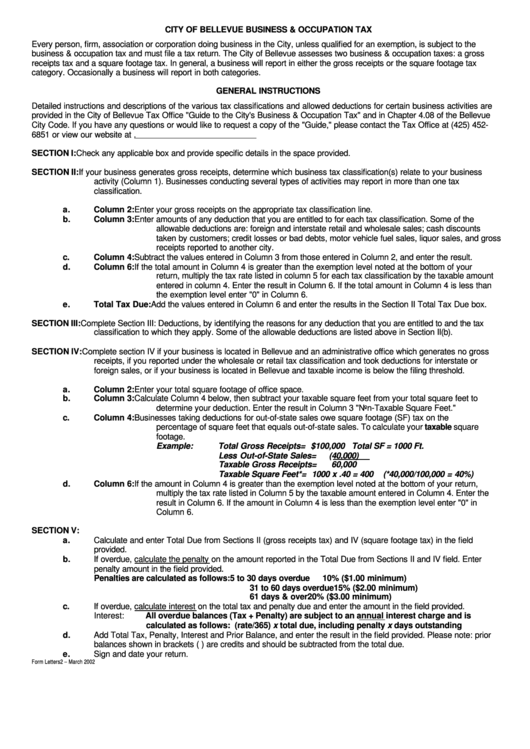

CITY OF BELLEVUE BUSINESS & OCCUPATION TAX

Every person, firm, association or corporation doing business in the City, unless qualified for an exemption, is subject to the

business & occupation tax and must file a tax return. The City of Bellevue assesses two business & occupation taxes: a gross

receipts tax and a square footage tax. In general, a business will report in either the gross receipts or the square footage tax

category. Occasionally a business will report in both categories.

GENERAL INSTRUCTIONS

Detailed instructions and descriptions of the various tax classifications and allowed deductions for certain business activities are

provided in the City of Bellevue Tax Office "Guide to the City's Business & Occupation Tax" and in Chapter 4.08 of the Bellevue

City Code. If you have any questions or would like to request a copy of the "Guide," please contact the Tax Office at (425) 452-

6851 or view our website at

SECTION I:

Check any applicable box and provide specific details in the space provided.

SECTION II:

If your business generates gross receipts, determine which business tax classification(s) relate to your business

activity (Column 1). Businesses conducting several types of activities may report in more than one tax

classification.

a.

Column 2:

Enter your gross receipts on the appropriate tax classification line.

b.

Column 3:

Enter amounts of any deduction that you are entitled to for each tax classification. Some of the

allowable deductions are: foreign and interstate retail and wholesale sales; cash discounts

taken by customers; credit losses or bad debts, motor vehicle fuel sales, liquor sales, and gross

receipts reported to another city.

c.

Column 4:

Subtract the values entered in Column 3 from those entered in Column 2, and enter the result.

d.

Column 6:

If the total amount in Column 4 is greater than the exemption level noted at the bottom of your

return, multiply the tax rate listed in column 5 for each tax classification by the taxable amount

entered in column 4. Enter the result in Column 6. If the total amount in Column 4 is less than

the exemption level enter "0" in Column 6.

e.

Total Tax Due: Add the values entered in Column 6 and enter the results in the Section II Total Tax Due box.

SECTION III:

Complete Section III: Deductions, by identifying the reasons for any deduction that you are entitled to and the tax

classification to which they apply. Some of the allowable deductions are listed above in Section II(b).

SECTION IV:

Complete section IV if your business is located in Bellevue and an administrative office which generates no gross

receipts, if you reported under the wholesale or retail tax classification and took deductions for interstate or

foreign sales, or if your business is located in Bellevue and taxable income is below the filing threshold.

a.

Column 2:

Enter your total square footage of office space.

b.

Column 3:

Calculate Column 4 below, then subtract your taxable square feet from your total square feet to

determine your deduction. Enter the result in Column 3 "Non-Taxable Square Feet."

c.

Column 4:

Businesses taking deductions for out-of-state sales owe square footage (SF) tax on the

percentage of square feet that equals out-of-state sales. To calculate your taxable square

footage.

Example:

Total Gross Receipts

= $100,000 Total SF = 1000 Ft.

Less Out-of-State Sales

=

(40,000)

Taxable Gross Receipts

=

60,000

Taxable Square Feet*

= 1000 x .40 = 400

(*40,000/100,000 = 40%)

d.

Column 6:

If the amount in Column 4 is greater than the exemption level noted at the bottom of your return,

multiply the tax rate listed in Column 5 by the taxable amount entered in Column 4. Enter the

result in Column 6. If the amount in Column 4 is less than the exemption level enter "0" in

Column 6.

SECTION V:

a.

Calculate and enter Total Due from Sections II (gross receipts tax) and IV (square footage tax) in the field

provided.

b.

If overdue, calculate the penalty on the amount reported in the Total Due from Sections II and IV field. Enter

penalty amount in the field provided.

Penalties are calculated as follows:

5 to 30 days overdue

10% ($1.00 minimum)

31 to 60 days overdue 15% ($2.00 minimum)

61 days & over

20% ($3.00 minimum)

c.

If overdue, calculate interest on the total tax and penalty due and enter the amount in the field provided.

Interest:

All overdue balances (Tax + Penalty) are subject to an annual interest charge and is

calculated as follows: (rate/365) x total due, including penalty x days outstanding

d.

Add Total Tax, Penalty, Interest and Prior Balance, and enter the result in the field provided. Please note: prior

balances shown in brackets ( ) are credits and should be subtracted from the total due.

e.

Sign and date your return.

Form Letters2 – March 2002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1