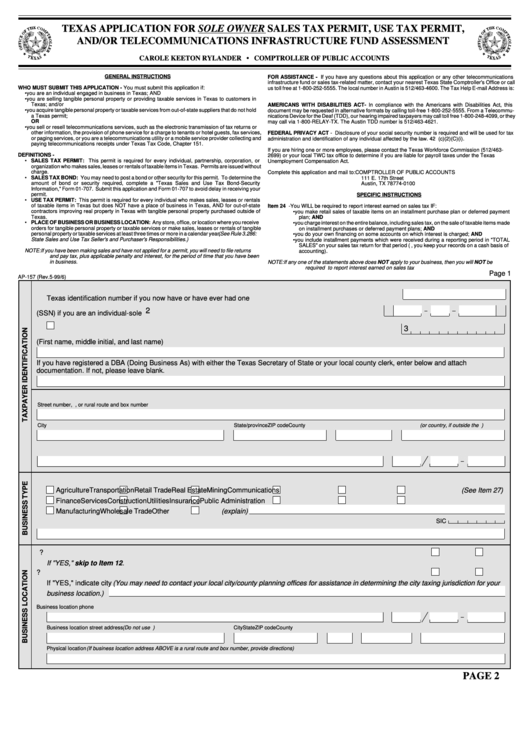

TEXAS APPLICATION FOR SOLE OWNER SALES TAX PERMIT, USE TAX PERMIT,

AND/OR TELECOMMUNICATIONS INFRASTRUCTURE FUND ASSESSMENT

CAROLE KEETON RYLANDER • COMPTROLLER OF PUBLIC ACCOUNTS

GENERAL INSTRUCTIONS

FOR ASSISTANCE - If you have any questions about this application or any other telecommunications

infrastructure fund or sales tax-related matter, contact your nearest Texas State Comptroller's Office or call

WHO MUST SUBMIT THIS APPLICATION - You must submit this application if:

us toll free at 1-800-252-5555. The local number in Austin is 512/463-4600. The Tax Help E-mail Address is:

• you are an individual engaged in business in Texas; AND

tax.help@cpa.state.tx.us

• you are selling tangible personal property or providing taxable services in Texas to customers in

Texas; and/or

AMERICANS WITH DISABILITIES ACT- In compliance with the Americans with Disabilities Act, this

• you acquire tangible personal property or taxable services from out-of-state suppliers that do not hold

document may be requested in alternative formats by calling toll-free 1-800-252-5555. From a Telecommu-

a Texas permit;

nications Device for the Deaf (TDD), our hearing impaired taxpayers may call toll free 1-800-248-4099, or they

OR

may call via 1-800-RELAY-TX. The Austin TDD number is 512/463-4621.

• you sell or resell telecommunications services, such as the electronic transmission of tax returns or

other information, the provision of phone service for a charge to tenants or hotel guests, fax services,

FEDERAL PRIVACY ACT - Disclosure of your social security number is required and will be used for tax

or paging services, or you are a telecommunications utility or a mobile service provider collecting and

administration and identification of any individual affected by the law. 42 U.S.C. sec. 405(c)(2)(C)(i).

paying telecommunications receipts under Texas Tax Code, Chapter 151.

If you are hiring one or more employees, please contact the Texas Workforce Commission (512/463-

DEFINITIONS -

2699) or your local TWC tax office to determine if you are liable for payroll taxes under the Texas

• SALES TAX PERMIT: This permit is required for every individual, partnership, corporation, or

Unemployment Compensation Act.

organization who makes sales, leases or rentals of taxable items in Texas. Permits are issued without

charge.

Complete this application and mail to:

COMPTROLLER OF PUBLIC ACCOUNTS

• SALES TAX BOND: You may need to post a bond or other security for this permit. To determine the

111 E. 17th Street

amount of bond or security required, complete a "Texas Sales and Use Tax Bond-Security

Austin, TX 78774-0100

Information," Form 01-707. Submit this application and Form 01-707 to avoid delay in receiving your

permit.

SPECIFIC INSTRUCTIONS

• USE TAX PERMIT: This permit is required for every individual who makes sales, leases or rentals

of taxable items in Texas but does NOT have a place of business in Texas, AND for out-of-state

Item 24 - You WILL be required to report interest earned on sales tax IF:

contractors improving real property in Texas with tangible personal property purchased outside of

• you make retail sales of taxable items on an installment purchase plan or deferred payment

Texas.

plan; AND

• PLACE OF BUSINESS OR BUSINESS LOCATION: Any store, office, or location where you receive

• you charge interest on the entire balance, including sales tax, on the sale of taxable items made

orders for tangible personal property or taxable services or make sales, leases or rentals of tangible

on installment purchases or deferred payment plans; AND

personal property or taxable services at least three times or more in a calendar year. (See Rule 3.286:

• you do your own financing on some accounts on which interest is charged; AND

State Sales and Use Tax Seller's and Purchaser's Responsibilities.)

• you include installment payments which were received during a reporting period in "TOTAL

SALES" on your sales tax return for that period (i.e., you keep your records on a cash basis of

NOTE:

If you have been making sales and have not applied for a permit, you will need to file returns

accounting).

and pay tax, plus applicable penalty and interest, for the period of time that you have been

in business.

NOTE:

If any one of the statements above does NOT apply to your business, then you will NOT be

required to report interest earned on sales tax .

Page 1

AP-157 (Rev.5-99/6)

1. Taxpayer number for reporting any Texas tax OR

Texas identification number if you now have or have ever had one ...............................................................................

2

2. Social security number (SSN) if you are an individual-sole owner ......................................................................

3.

Check here if you do not have a SSN.

3

4. Legal name of sole owner (First name, middle initial, and last name)

If you have registered a DBA (Doing Business As) with either the Texas Secretary of State or your local county clerk, enter below and attach

documentation. If not, please leave blank.

5. Mailing address

Street number, P.O. Box, or rural route and box number

City

State/province

ZIP code

County (or country, if outside the U.S.)

6. Name and daytime phone number of person to contact regarding day to day business operations

7. Principal type of business

Agriculture

Transportation

Retail Trade

Real Estate

Mining

Communications (See Item 27)

Finance

Services

Construction

Utilities

Insurance

Public Administration

Other (explain)

Manufacturing

Wholesale Trade

8. Primary business activities and type of products or services to be sold

SIC

9. Is your business located outside Texas? ......................................................................................................................................

YES

NO

If "YES," skip to Item 12.

10. Is your business located inside the boundaries of an incorporated city? .....................................................................................

YES

NO

If "YES," indicate city (You may need to contact your local city/county planning offices for assistance in determining the city taxing jurisdiction for your

business location.)

11. Business location name

Business location phone

Business location street address (Do not use P.O. Box or rural route.)

City

State

ZIP code

County

Physical location (If business location address ABOVE is a rural route and box number, provide directions)

PAGE 2

1

1