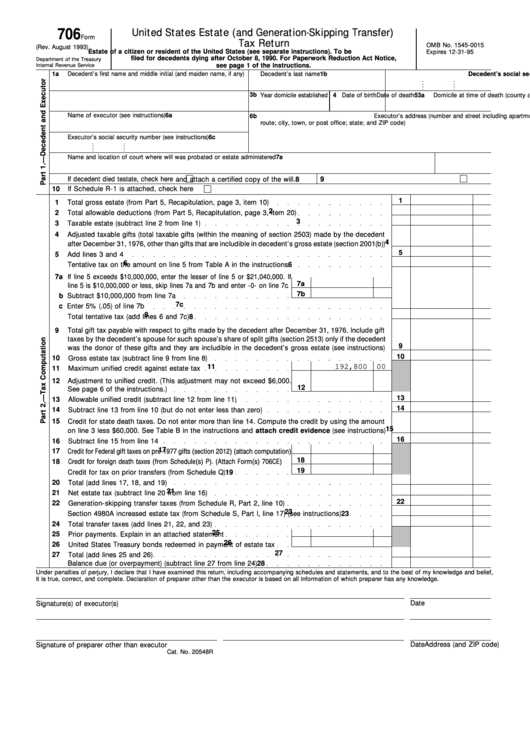

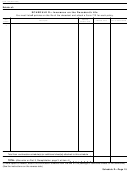

Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return

ADVERTISEMENT

706

United States Estate (and Generation-Skipping Transfer)

Form

Tax Return

OMB No. 1545-0015

(Rev. August 1993)

Estate of a citizen or resident of the United States (see separate instructions). To be

Expires 12-31-95

filed for decedents dying after October 8, 1990. For Paperwork Reduction Act Notice,

Department of the Treasury

see page 1 of the instructions.

Internal Revenue Service

1a

Decedent’s first name and middle initial (and maiden name, if any)

1b

Decedent’s last name

2

Decedent’s social security no.

3b Year domicile established 4 Date of birth

3a

Domicile at time of death (county and state, or foreign country)

5

Date of death

6a

Name of executor (see instructions)

6b

Executor’s address (number and street including apartment or suite no. or rural

route; city, town, or post office; state; and ZIP code)

6c

Executor’s social security number (see instructions)

7a

Name and location of court where will was probated or estate administered

7b Case number

8

If decedent died testate, check here

and attach a certified copy of the will.

9

If Form 4768 is attached, check here

10

If Schedule R-1 is attached, check here

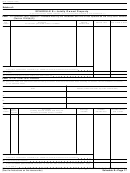

1

1

Total gross estate (from Part 5, Recapitulation, page 3, item 10)

2

2

Total allowable deductions (from Part 5, Recapitulation, page 3, item 20)

3

3

Taxable estate (subtract line 2 from line 1)

4

Adjusted taxable gifts (total taxable gifts (within the meaning of section 2503) made by the decedent

4

after December 31, 1976, other than gifts that are includible in decedent’s gross estate (section 2001(b))

5

5

Add lines 3 and 4

6

6

Tentative tax on the amount on line 5 from Table A in the instructions

7a If line 5 exceeds $10,000,000, enter the lesser of line 5 or $21,040,000. If

7a

line 5 is $10,000,000 or less, skip lines 7a and 7b and enter -0- on line 7c

7b

b Subtract $10,000,000 from line 7a

7c

c Enter 5% (.05) of line 7b

8

8

Total tentative tax (add lines 6 and 7c)

Total gift tax payable with respect to gifts made by the decedent after December 31, 1976. Include gift

9

taxes by the decedent’s spouse for such spouse’s share of split gifts (section 2513) only if the decedent

9

was the donor of these gifts and they are includible in the decedent’s gross estate (see instructions)

10

10

Gross estate tax (subtract line 9 from line 8)

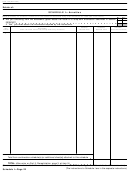

11

192,800

00

11

Maximum unified credit against estate tax

12

Adjustment to unified credit. (This adjustment may not exceed $6,000.

12

See page 6 of the instructions.)

13

13

Allowable unified credit (subtract line 12 from line 11)

14

14

Subtract line 13 from line 10 (but do not enter less than zero)

15

Credit for state death taxes. Do not enter more than line 14. Compute the credit by using the amount

15

on line 3 less $60,000. See Table B in the instructions and attach credit evidence (see instructions)

16

16

Subtract line 15 from line 14

17

17

Credit for Federal gift taxes on pre-1977 gifts (section 2012) (attach computation)

18

18

Credit for foreign death taxes (from Schedule(s) P). (Attach Form(s) 706CE)

19

19

Credit for tax on prior transfers (from Schedule Q)

20

20

Total (add lines 17, 18, and 19)

21

21

Net estate tax (subtract line 20 from line 16)

22

22

Generation-skipping transfer taxes (from Schedule R, Part 2, line 10)

23

23

Section 4980A increased estate tax (from Schedule S, Part I, line 17) (see instructions)

24

24

Total transfer taxes (add lines 21, 22, and 23)

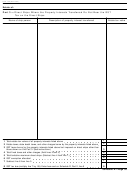

25

25

Prior payments. Explain in an attached statement

26

26

United States Treasury bonds redeemed in payment of estate tax

27

27

Total (add lines 25 and 26)

28

Balance due (or overpayment) (subtract line 27 from line 24)

28

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete. Declaration of preparer other than the executor is based on all information of which preparer has any knowledge.

Date

Signature(s) of executor(s)

Address (and ZIP code)

Date

Signature of preparer other than executor

Cat. No. 20548R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41