Instructions For Form Git-317 - Sheltered Workshop Tax Credit

ADVERTISEMENT

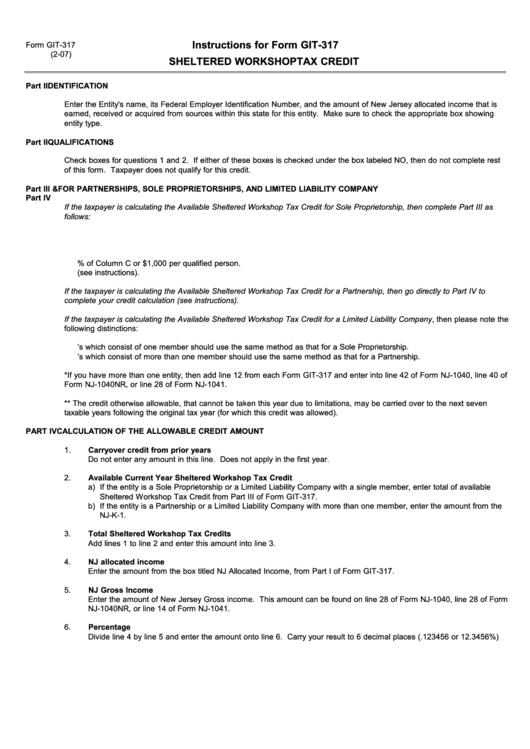

Instructions for Form GIT-317

Form GIT-317

(2-07)

SHELTERED WORKSHOP TAX CREDIT

Part I

IDENTIFICATION

Enter the Entity's name, its Federal Employer Identification Number, and the amount of New Jersey allocated income that is

earned, received or acquired from sources within this state for this entity. Make sure to check the appropriate box showing

entity type.

Part II

QUALIFICATIONS

Check boxes for questions 1 and 2. If either of these boxes is checked under the box labeled NO, then do not complete rest

of this form. Taxpayer does not qualify for this credit.

Part III & FOR PARTNERSHIPS, SOLE PROPRIETORSHIPS, AND LIMITED LIABILITY COMPANY

Part IV

If the taxpayer is calculating the Available Sheltered Workshop Tax Credit for Sole Proprietorship, then complete Part III as

follows:

A. Enter the Name of each Qualified Person employed by your business.

B. Enter the Social Security Number of each Qualified Person employed by your business.

C. Enter the Salary and Wages paid during the tax year.

D. Enter the lesser of 20% of Column C or $1,000 per qualified person.

E. Complete Part IV (see instructions).

If the taxpayer is calculating the Available Sheltered Workshop Tax Credit for a Partnership, then go directly to Part IV to

complete your credit calculation (see instructions).

If the taxpayer is calculating the Available Sheltered Workshop Tax Credit for a Limited Liability Company, then please note the

following distinctions:

A. LLC’s which consist of one member should use the same method as that for a Sole Proprietorship.

B. LLC’s which consist of more than one member should use the same method as that for a Partnership.

*If you have more than one entity, then add line 12 from each Form GIT-317 and enter into line 42 of Form NJ-1040, line 40 of

Form NJ-1040NR, or line 28 of Form NJ-1041.

** The credit otherwise allowable, that cannot be taken this year due to limitations, may be carried over to the next seven

taxable years following the original tax year (for which this credit was allowed).

PART IV CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

1.

Carryover credit from prior years

Do not enter any amount in this line. Does not apply in the first year.

2.

Available Current Year Sheltered Workshop Tax Credit

a) If the entity is a Sole Proprietorship or a Limited Liability Company with a single member, enter total of available

Sheltered Workshop Tax Credit from Part III of Form GIT-317.

b) If the entity is a Partnership or a Limited Liability Company with more than one member, enter the amount from the

NJ-K-1.

3.

Total Sheltered Workshop Tax Credits

Add lines 1 to line 2 and enter this amount into line 3.

4.

NJ allocated income

Enter the amount from the box titled NJ Allocated Income, from Part I of Form GIT-317.

5.

NJ Gross Income

Enter the amount of New Jersey Gross income. This amount can be found on line 28 of Form NJ-1040, line 28 of Form

NJ-1040NR, or line 14 of Form NJ-1041.

6.

Percentage

Divide line 4 by line 5 and enter the amount onto line 6. Carry your result to 6 decimal places (.123456 or 12.3456%)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2