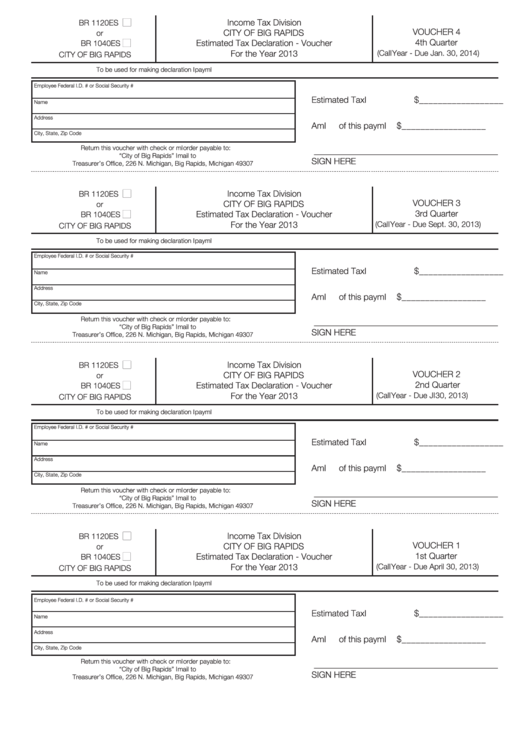

Estimated Tax Declaration Voucher - City Of Big Rapids - 2013

ADVERTISEMENT

income Tax Division

BR 1120es

VOUcheR 4

ciTy Of BiG RAPiDs

or

4th Quarter

estimated Tax Declaration - Voucher

BR 1040es

for the year 2013

(calendar year - Due Jan. 30, 2014)

ciTy Of BiG RAPiDs

To be used for making declaration and payment

employee federal i.D. # or social security #

estimated Tax

$__________________

name

Address

Amount of this payment

$__________________

city, state, Zip code

Return this voucher with check or money order payable to:

__________________________________________

“city of Big Rapids” and mail to

siGn heRe

Treasurer’s Office, 226 n. Michigan, Big Rapids, Michigan 49307

income Tax Division

BR 1120es

VOUcheR 3

ciTy Of BiG RAPiDs

or

3rd Quarter

estimated Tax Declaration - Voucher

BR 1040es

for the year 2013

(calendar year - Due sept. 30, 2013)

ciTy Of BiG RAPiDs

To be used for making declaration and payment

employee federal i.D. # or social security #

estimated Tax

$__________________

name

Address

Amount of this payment

$__________________

city, state, Zip code

Return this voucher with check or money order payable to:

__________________________________________

“city of Big Rapids” and mail to

siGn heRe

Treasurer’s Office, 226 n. Michigan, Big Rapids, Michigan 49307

income Tax Division

BR 1120es

VOUcheR 2

ciTy Of BiG RAPiDs

or

2nd Quarter

estimated Tax Declaration - Voucher

BR 1040es

for the year 2013

(calendar year - Due June 30, 2013)

ciTy Of BiG RAPiDs

To be used for making declaration and payment

employee federal i.D. # or social security #

estimated Tax

$__________________

name

Address

Amount of this payment

$__________________

city, state, Zip code

Return this voucher with check or money order payable to:

__________________________________________

“city of Big Rapids” and mail to

siGn heRe

Treasurer’s Office, 226 n. Michigan, Big Rapids, Michigan 49307

income Tax Division

BR 1120es

VOUcheR 1

ciTy Of BiG RAPiDs

or

1st Quarter

estimated Tax Declaration - Voucher

BR 1040es

for the year 2013

(calendar year - Due April 30, 2013)

ciTy Of BiG RAPiDs

To be used for making declaration and payment

employee federal i.D. # or social security #

estimated Tax

$__________________

name

Address

Amount of this payment

$__________________

city, state, Zip code

Return this voucher with check or money order payable to:

__________________________________________

“city of Big Rapids” and mail to

siGn heRe

Treasurer’s Office, 226 n. Michigan, Big Rapids, Michigan 49307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1