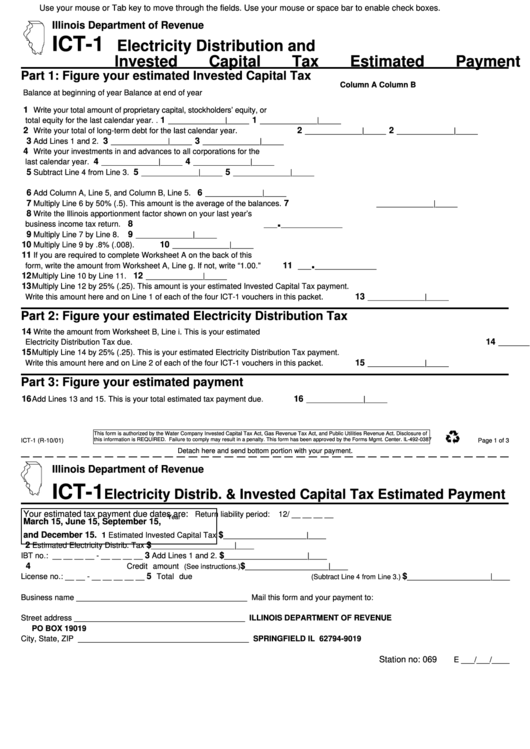

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

ICT-1

Electricity Distribution and

Invested Capital Tax Estimated Payment

Part 1: Figure your estimated Invested Capital Tax

Column A

Column B

Balance at beginning of year

Balance at end of year

1

Write your total amount of proprietary capital, stockholders’ equity, or

1

1

total equity for the last calendar year.

.

_____________|_____

_____________|_____

2

2

2

Write your total of long-term debt for the last calendar year.

_____________|_____

_____________|_____

3

3

3

Add Lines 1 and 2.

_____________|_____

_____________|_____

4

Write your investments in and advances to all corporations for the

4

4

last calendar year.

_____________|_____

_____________|_____

5

5

5

Subtract Line 4 from Line 3.

_____________|_____

_____________|_____

6

6

Add Column A, Line 5, and Column B, Line 5.

_____________|_____

7

7

Multiply Line 6 by 50% (.5). This amount is the average of the balances.

_____________|_____

8

Write the Illinois apportionment factor shown on your last year’s

.

8

business income tax return.

___

______________

9

9

Multiply Line 7 by Line 8.

_____________|_____

10

10

Multiply Line 9 by .8% (.008).

_____________|_____

11

If you are required to complete Worksheet A on the back of this

.

11

form, write the amount from Worksheet A, Line g. If not, write “1.00.”

___

______________

12

12

Multiply Line 10 by Line 11.

_____________|_____

13

Multiply Line 12 by 25% (.25). This amount is your estimated Invested Capital Tax payment.

13

Write this amount here and on Line 1 of each of the four ICT-1 vouchers in this packet.

_____________|_____

Part 2: Figure your estimated Electricity Distribution Tax

14

Write the amount from Worksheet B, Line i. This is your estimated

14

Electricity Distribution Tax due.

_____________|_____

15

Multiply Line 14 by 25% (.25). This is your estimated Electricity Distribution Tax payment.

15

Write this amount here and on Line 2 of each of the four ICT-1 vouchers in this packet.

_____________|_____

Part 3: Figure your estimated payment

16

16

Add Lines 13 and 15. This is your total estimated tax payment due.

_____________|_____

This form is authorized by the Water Company Invested Capital Tax Act, Gas Revenue Tax Act, and Public Utilities Revenue Act. Disclosure of

this information is REQUIRED. Failure to comply may result in a penalty. This form has been approved by the Forms Mgmt. Center. IL-492-0387

ICT-1 (R-10/01)

Page 1 of 3

Detach here and send bottom portion with your payment.

Illinois Department of Revenue

ICT-1

Electricity Distrib. & Invested Capital Tax Estimated Payment

Your estimated tax payment due dates are:

Return liability period:

12/ __ __ __ __

Year

March 15, June 15, September 15,

and December 15.

$

1 Estimated Invested Capital Tax

___________________|____

2

$

Estimated Electricity Distrib. Tax

___________________|____

3

$

IBT no.: __ __ __ __ - __ __ __ __

Add Lines 1 and 2.

___________________|____

4

$

Credit amount

___________________|____

(See instructions.)

5

$

License no.: __ __ - __ __ __ __ __

Total due

___________________|____

(Subtract Line 4 from Line 3.)

Business name _______________________________________ Mail this form and your payment to:

Street address

_______________________________________ ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

City, State, ZIP _______________________________________ SPRINGFIELD IL 62794-9019

Station no: 069

E ___/___/____

1

1 2

2 3

3