Important -- to ensure this form works properly,

Save

Print

Clear

save it to your computer before completing the form.

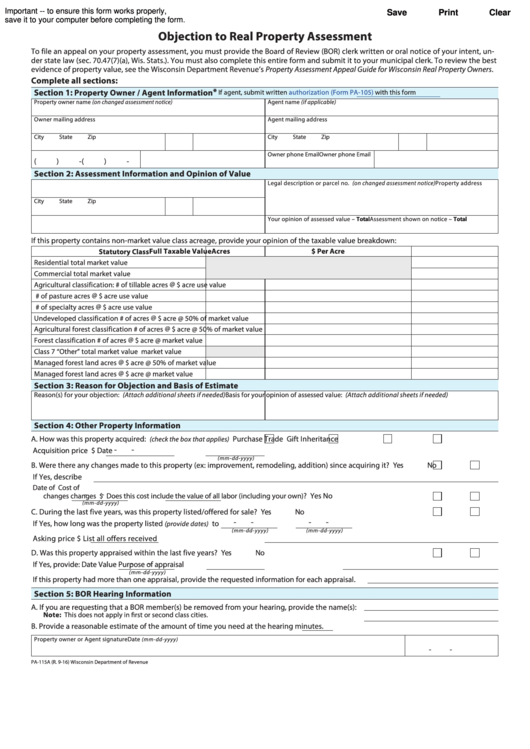

Objection to Real Property Assessment

To file an appeal on your property assessment, you must provide the Board of Review (BOR) clerk written or oral notice of your intent, un-

der state law (sec. 70.47(7)(a), Wis. Stats.). You must also complete this entire form and submit it to your municipal clerk. To review the best

evidence of property value, see the Wisconsin Department Revenue’s Property Assessment Appeal Guide for Wisconsin Real Property Owners.

Complete all sections:

*

Section 1: Property Owner / Agent Information

If agent, submit written

authorization (Form PA-105)

with this form

Property owner name (on changed assessment notice)

Agent name (if applicable)

Owner mailing address

Agent mailing address

City

State

Zip

City

State

Zip

Owner phone

Email

Owner phone

Email

(

)

-

(

)

-

Section 2: Assessment Information and Opinion of Value

Property address

Legal description or parcel no. (on changed assessment notice)

City

State

Zip

Assessment shown on notice – Total

Your opinion of assessed value – Total

If this property contains non-market value class acreage, provide your opinion of the taxable value breakdown:

Acres

$ Per Acre

Full Taxable Value

Statutory Class

Residential total market value

Commercial total market value

@

Agricultural classification:

# of tillable acres

$ acre use value

@

# of pasture acres

$ acre use value

@

# of specialty acres

$ acre use value

@

Undeveloped classification # of acres

$ acre @ 50% of market value

@

Agricultural forest classification # of acres

$ acre @ 50% of market value

@

Forest classification # of acres

$ acre @ market value

Class 7 “Other” total market value

market value

@

Managed forest land acres

$ acre @ 50% of market value

@

Managed forest land acres

$ acre @ market value

Section 3: Reason for Objection and Basis of Estimate

Reason(s) for your objection: (Attach additional sheets if needed)

Basis for your opinion of assessed value: (Attach additional sheets if needed)

Section 4: Other Property Information

A. How was this property acquired:

Purchase

Trade

Gift

Inheritance

(check the box that applies)

-

-

Acquisition price $

Date

(mm-dd-yyyy)

B. Were there any changes made to this property (ex: improvement, remodeling, addition) since acquiring it? . . . . . .

Yes

No

If Yes, describe

Date of

Cost of

-

-

?

Yes

No

changes

changes $

Does this cost include the value of all labor (including your own)

(mm-dd-yyyy)

C. During the last five years, was this property listed/offered for sale? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

-

-

-

-

If Yes, how long was the property listed

to

(provide dates)

(mm-dd-yyyy)

(mm-dd-yyyy)

Asking price $

List all offers received

D. Was this property appraised within the last five years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

-

-

If Yes, provide:

Date

Value

Purpose of appraisal

(mm-dd-yyyy)

If this property had more than one appraisal, provide the requested information for each appraisal.

Section 5: BOR Hearing Information

A. If you are requesting that a BOR member(s) be removed from your hearing, provide the name(s):

Note: This does not apply in first or second class cities.

B. Provide a reasonable estimate of the amount of time you need at the hearing

minutes.

Property owner or Agent signature

Date

(mm-dd-yyyy)

-

-

PA-115A (R. 9-16)

Wisconsin Department of Revenue

1

1