Consent To Release Tax Return Information

ADVERTISEMENT

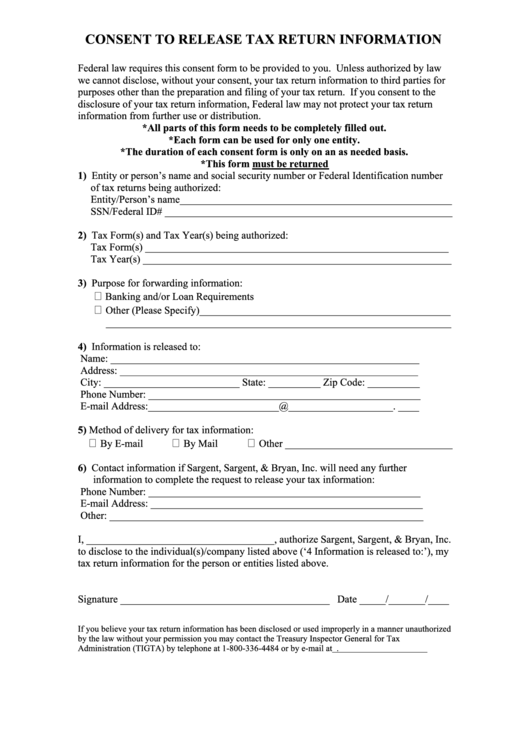

CONSENT TO RELEASE TAX RETURN INFORMATION

Federal law requires this consent form to be provided to you. Unless authorized by law

we cannot disclose, without your consent, your tax return information to third parties for

purposes other than the preparation and filing of your tax return. If you consent to the

disclosure of your tax return information, Federal law may not protect your tax return

information from further use or distribution.

*All parts of this form needs to be completely filled out.

*Each form can be used for only one entity.

*The duration of each consent form is only on an as needed basis.

*This form must be returned

1) Entity or person’s name and social security number or Federal Identification number

of tax returns being authorized:

Entity/Person’s name____________________________________________________

SSN/Federal ID# _______________________________________________________

2) Tax Form(s) and Tax Year(s) being authorized:

Tax Form(s) __________________________________________________________

Tax Year(s) ___________________________________________________________

3) Purpose for forwarding information:

Banking and/or Loan Requirements

Other (Please Specify)________________________________________________

__________________________________________________________________

4) Information is released to:

Name: ___________________________________________________________

Address: _________________________________________________________

City: __________________________ State: __________ Zip Code: __________

Phone Number: ____________________________________________________

E-mail Address:_________________________@____________________. ____

5) Method of delivery for tax information:

By E-mail

By Mail

Other ________________________________

6) Contact information if Sargent, Sargent, & Bryan, Inc. will need any further

information to complete the request to release your tax information:

Phone Number: ____________________________________________________

E-mail Address: ____________________________________________________

Other: ____________________________________________________________

I, ____________________________________, authorize Sargent, Sargent, & Bryan, Inc.

to disclose to the individual(s)/company listed above (‘4 Information is released to:’), my

tax return information for the person or entities listed above.

Signature ________________________________________ Date _____/_______/____

If you believe your tax return information has been disclosed or used improperly in a manner unauthorized

by the law without your permission you may contact the Treasury Inspector General for Tax

Administration (TIGTA) by telephone at 1-800-336-4484 or by e-mail at complaints@tigta.treas.gov.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1