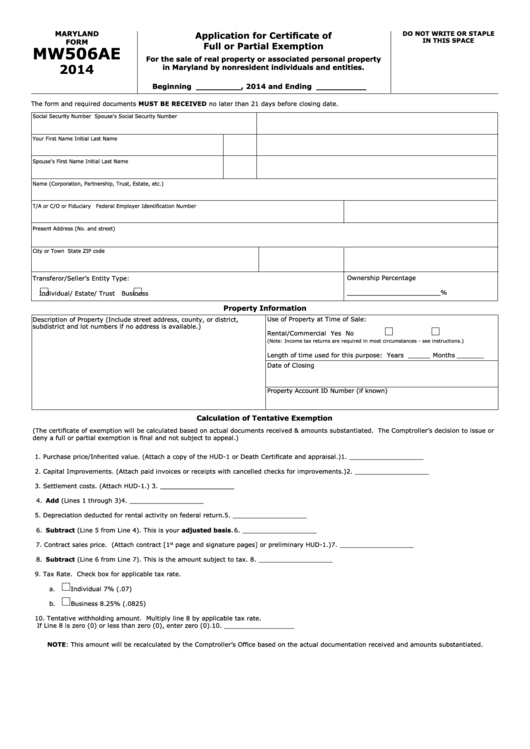

MARYLAND

DO NOT WRITE OR STAPLE

Application for Certificate of

IN THIS SPACE

FORM

Full or Partial Exemption

MW506AE

For the sale of real property or associated personal property

2014

in Maryland by nonresident individuals and entities.

Beginning _________ , 2014 and Ending __________

The form and required documents MUST BE RECEIVED no later than 21 days before closing date.

Social Security Number

Spouse's Social Security Number

Your First Name

Initial

Last Name

Spouse's First Name

Initial

Last Name

Name (Corporation, Partnership, Trust, Estate, etc.)

T/A or C/O or Fiduciary

Federal Employer Identification Number

Present Address (No. and street)

City or Town

State

ZIP code

Ownership Percentage

Transferor/Seller’s Entity Type:

________________________%

Individual/ Estate/ Trust

Business

Property Information

Description of Property (Include street address, county, or district,

Use of Property at Time of Sale:

subdistrict and lot numbers if no address is available.)

Rental/Commercial

Yes

No

(Note: Income tax returns are required in most circumstances - see instructions.)

Length of time used for this purpose: Years ______ Months _______

Date of Closing

Property Account ID Number (if known)

Calculation of Tentative Exemption

(The certificate of exemption will be calculated based on actual documents received & amounts substantiated. The Comptroller’s decision to issue or

deny a full or partial exemption is final and not subject to appeal.)

1. Purchase price/Inherited value. (Attach a copy of the HUD-1 or Death Certificate and appraisal.) . . . . . . . . . . . . 1. ___________________

2. Capital Improvements. (Attach paid invoices or receipts with cancelled checks for improvements.) . . . . . . . . . . . 2. ___________________

3. Settlement costs. (Attach HUD-1.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. ___________________

4. Add (Lines 1 through 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. ___________________

5. Depreciation deducted for rental activity on federal return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. ___________________

6. Subtract (Line 5 from Line 4). This is your adjusted basis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. ___________________

7. Contract sales price. (Attach contract [1

page and signature pages] or preliminary HUD-1.) . . . . . . . . . . . . . . . 7. ___________________

st

8. Subtract (Line 6 from Line 7). This is the amount subject to tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. ___________________

9. Tax Rate. Check box for applicable tax rate.

a.

Individual

7% (.07)

b.

Business

8.25% (.0825)

10. Tentative withholding amount. Multiply line 8 by applicable tax rate.

If Line 8 is zero (0) or less than zero (0), enter zero (0). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10. __________________

NOTE: This amount will be recalculated by the Comptroller’s Office based on the actual documentation received and amounts substantiated.

1

1 2

2