High-Technology Investment Tax Credit Worksheet - 2004

ADVERTISEMENT

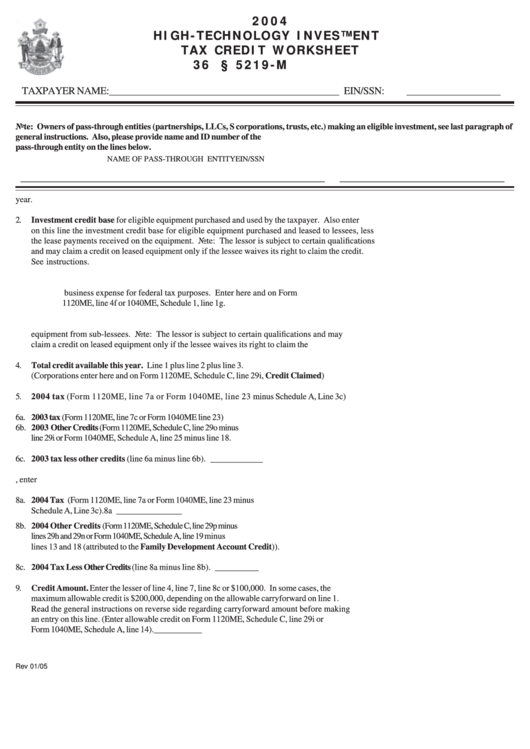

2004

HIGH-TECHNOLOGY INVESTMENT

TAX CREDIT WORKSHEET

36 M.R.S.A. § 5219-M

TAXPAYER NAME: ____________________________________________ EIN/SSN:

__________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible investment, see last paragraph of

general instructions. Also, please provide name and ID number of the

pass-through entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

_____________________________________________________________

_________________________________

1.

Carryforward from previous year. ............................................................................................................................. 1 _______________

2.

Investment credit base for eligible equipment purchased and used by the taxpayer. Also enter

on this line the investment credit base for eligible equipment purchased and leased to lessees, less

the lease payments received on the equipment. Note: The lessor is subject to certain qualifications

and may claim a credit on leased equipment only if the lessee waives its right to claim the credit.

See instructions. ....................................................................................................................................................... 2 _______________

2a. Amount of investment credit base from line 2 also claimed as a

business expense for federal tax purposes. Enter here and on Form

1120ME, line 4f or 1040ME, Schedule 1, line 1g. ..................................................... 2a _______________

3.

Enter lease payments paid on eligible equipment less any lease payments received on the

equipment from sub-lessees. Note: The lessor is subject to certain qualifications and may

claim a credit on leased equipment only if the lessee waives its right to claim the credit. ........................................ 3 _______________

4.

Total credit available this year. Line 1 plus line 2 plus line 3.

(Corporations enter here and on Form 1120ME, Schedule C, line 29i, Credit Claimed) ........................................... 4 _______________

5.

2004 tax (Form 1120ME, line 7a or Form 1040ME, line 23 minus Schedule A, Line 3c) ................................... 5 _______________

6a. 2003 tax (Form 1120ME, line 7c or Form 1040ME line 23) .................................................... 6a ______________

6b. 2003 Other Credits (Form 1120ME, Schedule C, line 29o minus

line 29i or Form 1040ME, Schedule A, line 25 minus line 18. ................................................ 6b ______________

6c. 2003 tax less other credits (line 6a minus line 6b). .................................................................................................. 6c _______________

7.

Subtract line 6c from line 5 and enter the difference here. If zero or less, enter zero. ................................................ 7 _______________

8a. 2004 Tax (Form 1120ME, line 7a or Form 1040ME, line 23 minus

Schedule A, Line 3c). .......................................................................................................... 8a _______________

8b. 2004 Other Credits (Form 1120ME, Schedule C, line 29p minus

lines 29h and 29n or Form 1040ME, Schedule A, line 19 minus

lines 13 and 18 (attributed to the Family Development Account Credit)). .......................... 8b _______________

8c. 2004 Tax Less Other Credits (line 8a minus line 8b). ................................................................................................ 8c _______________

9.

Credit Amount. Enter the lesser of line 4, line 7, line 8c or $100,000. In some cases, the

maximum allowable credit is $200,000, depending on the allowable carryforward on line 1.

Read the general instructions on reverse side regarding carryforward amount before making

an entry on this line. (Enter allowable credit on Form 1120ME, Schedule C, line 29i or

Form 1040ME, Schedule A, line 14). .......................................................................................................................... 9 _______________

Rev 01/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1