Form Uct-43 - Preliminary Report - 2012

ADVERTISEMENT

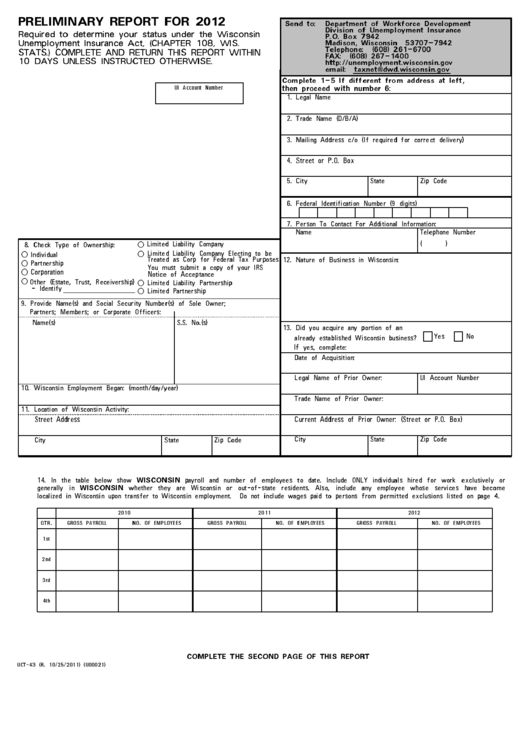

PRELIMINARY REPORT FOR 2012

Send to: Department of Workforce Development

Division of Unemployment Insurance

Required to determine your status under the Wisconsin

P.O. Box 7942

Unemployment Insurance Act, (CHAPTER 108, WIS.

Madison, Wisconsin 53707-7942

Telephone: (608) 261-6700

STATS.) COMPLETE AND RETURN THIS REPORT WITHIN

FAX: (608) 267-1400

10 DAYS UNLESS INSTRUCTED OTHERWISE.

email: taxnet@dwd.wisconsin.gov

Complete 1-5 If different from address at left,

then proceed with number 6:

UI Account Number

1. Legal Name

2. Trade Name (D/B/A)

3. Mailing Address c/o (If required for correct delivery)

4. Street or P.O. Box

5. City

State

Zip Code

6. Federal Identification Number (9 digits)

7. Person To Contact For Additional Information:

Name

Telephone Number

8

(

)

Limited Liability Company

8. Check Type of Ownership:

8

8 8 8

Limited Liability Company Electing to be

Individual

Treated as Corp for Federal Tax Purposes

12. Nature of Business in Wisconsin:

Partnership

You must submit a copy of your IRS

Corporation

8

8 8

Notice of Acceptance

Other (Estate, Trust, Receivership)

Limited Liability Partnership

- Identify

Limited Partnership

9. Provide Name(s) and Social Security Number(s) of Sole Owner;

Partners; Members; or Corporate Officers:

Name(s)

S.S. No.(s)

13. Did you acquire any portion of an

Yes

No

already established Wisconsin business?

If yes, complete:

Date of Acquisition:

Legal Name of Prior Owner:

UI Account Number

10. Wisconsin Employment Began: (month/day/year)

Trade Name of Prior Owner:

11. Location of Wisconsin Activity:

Street Address

Current Address of Prior Owner: (Street or P.O. Box)

City

State

Zip Code

City

State

Zip Code

WISCONSIN

14. In the table below show

payroll and number of employees to date. Include ONLY individuals hired for work exclusively or

WISCONSIN

generally in

whether they are Wisconsin or out-of-state residents. Also, include any employee whose services have become

localized in Wisconsin upon transfer to Wisconsin employment. Do not include wages paid to persons from permitted exclusions listed on page 4.

2010

2011

2012

QTR.

GROSS PAYROLL

NO. OF EMPLOYEES

GROSS PAYROLL

NO. OF EMPLOYEES

GROSS PAYROLL

NO. OF EMPLOYEES

1st

2nd

3rd

4th

COMPLETE THE SECOND PAGE OF THIS REPORT

UCT-43 (R. 10/25/2011) (U00021)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2