General Instructions For Preparing Employer'S Quarter/monthly Amended Missouri Withholding Tax Return (Form Mo-941x) - 1996

ADVERTISEMENT

— PLEASE TRIM ON THE DOTTED LINE PRIOR TO FILING —

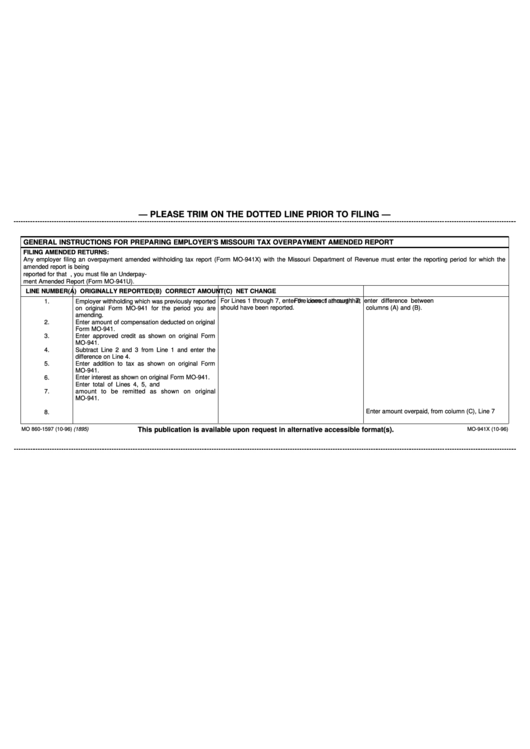

GENERAL INSTRUCTIONS FOR PREPARING EMPLOYER’S MISSOURI TAX OVERPAYMENT AMENDED REPORT

FILING AMENDED RETURNS:

Any employer filing an overpayment amended withholding tax report (Form MO-941X) with the Missouri Department of Revenue must enter the reporting period for which the

amended report is being filed. An overpayment amended report is required if the amount of withholding tax reported for a particular period is less than the original net withholding

reported for that period. If the amount of withholding tax reported for a particular period is more than the original net withholding reported for the period, you must file an Underpay-

ment Amended Report (Form MO-941U).

LINE NUMBER

(A) ORIGINALLY REPORTED

(B) CORRECT AMOUNT

(C) NET CHANGE

For Lines 1 through 7, enter the correct amount that

For Lines 1 through 7, enter difference between

1.

Employer withholding which was previously reported

should have been reported.

columns (A) and (B).

on original Form MO-941 for the period you are

amending.

2.

Enter amount of compensation deducted on original

Form MO-941.

3.

Enter approved credit as shown on original Form

MO-941.

4.

Subtract Line 2 and 3 from Line 1 and enter the

difference on Line 4.

5.

Enter addition to tax as shown on original Form

MO-941.

6.

Enter interest as shown on original Form MO-941.

Enter total of Lines 4, 5, and 6. This is the total

7.

amount to be remitted as shown on original

MO-941.

Enter amount overpaid, from column (C), Line 7

8.

MO 860-1597 (10-96) (1895)

This publication is available upon request in alternative accessible format(s).

MO-941X (10-96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1