Instructions For Preparing The Anti-Litter Tax Return (Form 7580) - Chicago Department Of Revenue

ADVERTISEMENT

II

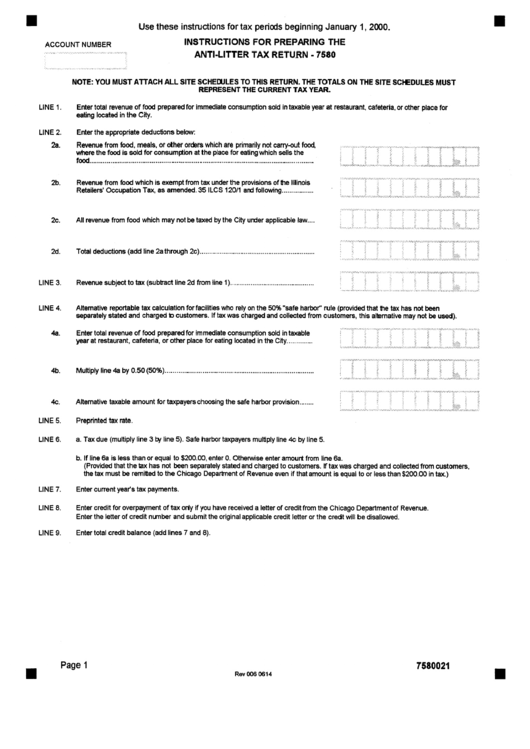

Use these instructions for tax periods beginning January I 2000

ACCOUNT NUMBER

INSTRUCTIONS FOR PREPARING THE

............................................................................................

~

A N T I ' L I T T E R

TAX

R E T U R N

- 7580

. . . . . . .

_

+ _ :

:

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE SCHEDULES MUST

REPRESENT THE CURRENT TAX YEAR.

LINE 1.

Enter total revenue of food prepared for immediate consumption sold in taxable year at restaurant, cafeteria, or other place for

eating located in the City.

LINE 2.

2a.

Enter the appropriate deduc'dons below:

Revenue from food, meals, or other orders which are primarily not carry-out food,

where the food is sold for consumption at the place for eating which sells the

f o o d

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

......................

: ...................... ~ .............. ......... : ......

. ............. ~ ............. !!~.'.'.'.'r'.'il ~ ............ !!

2b.

Revenue from food which is exempt from tax under the provisions of me Illinois

Retailers' Occupation Tax, as amended. 35 ILCS 120/1 and following .................

2c.

All revenue from food which may not be taxed by the City under applicable law ....

............................................................................. i

............ i .................. i ...........

2d.

Total deductions (add line 2athrough 2c)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i ............. ii~"T'"•~i

............. i ~ ............. ~i

............. il

............. ii~ '"ii ............. ]i ............. il ............. ii

LINE 3.

Revenue subject to tax (subtract line 2d from line 1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

i

LINE 4.

4a.

Altemative reportable tax calculation for facilities who rely on the 50%"safe harbor" rule (provided that me tax has not been

separately stated and charged to customers. If tax was charged and collected from customers, this alternative may not be used).

Enter total revenue of food prepared for immediate consumption sold in taxable

year at restaurant, cafeteria, or other place for eating located in the City ..............

4b.

Multiply line 4a by 0.50 (50%)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LINE 5.

Alternative taxable amount for taxpayers choosing the safe harbor provision ........

Preprinted tax rate.

LINE 6.

a. Tax due (multiply line 3 by line 5). Safe harbor taxpayers multiply line 4c by line 5.

LINE 7.

b. If line 6a is less than or equal to $200.00, enter 0. Otherwise enter amount from line 6a.

(Provided that the ==x has not been separately stated and charged to customers. If tax was charged and collected from customers,

the tax must be remitted to the Chicago Department of Revenue even if that amount is equal to or less than $200.00 in tax.)

Enter current year's tax payments.

LINE 8.

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department of Revenue.

Enter the letter of credit number and submit the original applicable credit letter or the credt will be disallowed.

LINE 9.

Enter total credit balance (add lines 7 and 8).

m

Page 1

7580021

i

Rev0060614

•

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2