Form Ri-4868 - Application For Automatic Extension Of Time To File Rhode Island Individual Income Tax Return - 2010

ADVERTISEMENT

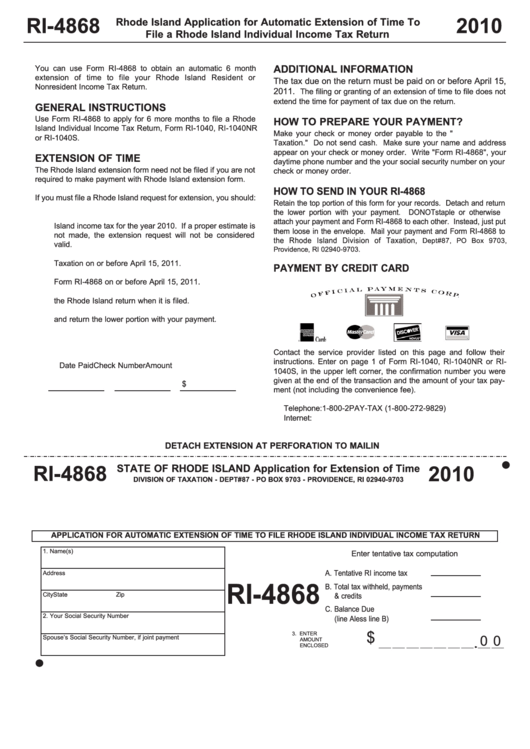

RI-4868

Rhode Island Application for Automatic Extension of Time To

2010

File a Rhode Island Individual Income Tax Return

You can use Form RI-4868 to obtain an automatic 6 month

ADDITIONAL INFORMATION

extension of time to file your Rhode Island Resident or

The tax due on the return must be paid on or before April 15,

Nonresident Income Tax Return.

2011.

The filing or granting of an extension of time to file does not

extend the time for payment of tax due on the return.

GENERAL INSTRUCTIONS

Use Form RI-4868 to apply for 6 more months to file a Rhode

HOW TO PREPARE YOUR PAYMENT?

Island Individual Income Tax Return, Form RI-1040, RI-1040NR

Make your check or money order payable to the "R.I. Division of

or RI-1040S.

Taxation." Do not send cash. Make sure your name and address

appear on your check or money order. Write "Form RI-4868", your

EXTENSION OF TIME

daytime phone number and the your social security number on your

The Rhode Island extension form need not be filed if you are not

check or money order.

required to make payment with Rhode Island extension form.

HOW TO SEND IN YOUR RI-4868

If you must file a Rhode Island request for extension, you should:

Retain the top portion of this form for your records. Detach and return

1. Prepare the Rhode Island Extension Form RI-4868.

the lower portion with your payment. DO NOT staple or otherwise

2. Clearly show the full amount properly estimated as Rhode

attach your payment and Form RI-4868 to each other. Instead, just put

Island income tax for the year 2010. If a proper estimate is

them loose in the envelope. Mail your payment and Form RI-4868 to

not made, the extension request will not be considered

the Rhode Island Division of Taxation,

Dept#87, PO Box 9703,

valid.

Providence, RI 02940-9703.

3. File the extension with the Rhode Island Division of

Taxation on or before April 15, 2011.

PAYMENT BY CREDIT CARD

4. Pay the amount of Rhode Island tax due as calculated on

Form RI-4868 on or before April 15, 2011.

5. Be sure to attach a copy of the Form RI-4868 to the front of

the Rhode Island return when it is filed.

6. Retain the top portion of this form for your records. Detach

and return the lower portion with your payment.

Contact the service provider listed on this page and follow their

instructions. Enter on page 1 of Form RI-1040, RI-1040NR or RI-

Date Paid

Check Number

Amount

1040S, in the upper left corner, the confirmation number you were

given at the end of the transaction and the amount of your tax pay-

$

ment (not including the convenience fee).

Telephone: 1-800-2PAY-TAX (1-800-272-9829)

Internet:

DETACH EXTENSION AT PERFORATION TO MAIL IN

STATE OF RHODE ISLAND Application for Extension of Time

RI-4868

2010

DIVISION OF TAXATION - DEPT#87 - PO BOX 9703 - PROVIDENCE, RI 02940-9703

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE RHODE ISLAND INDIVIDUAL INCOME TAX RETURN

1. Name(s)

Enter tentative tax computation

A. Tentative RI income tax

Address

B. Total tax withheld, payments

RI-4868

City

State

Zip

& credits

C. Balance Due

2. Your Social Security Number

(line A less line B)

3. ENTER

$

Spouse’s Social Security Number, if joint payment

0 0

AMOUNT

ENCLOSED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1