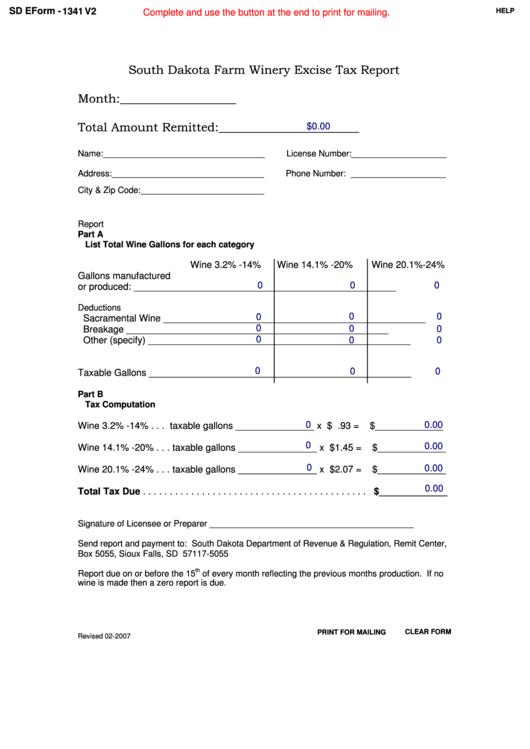

SD EForm - 1341 V2

HELP

Complete and use the button at the end to print for mailing.

South Dakota Farm Winery Excise Tax Report

Month:___________________

Total Amount Remitted:_______________________

$0.00

Name:__________________________________

License Number:____________________

Address:________________________________

Phone Number: ____________________

City & Zip Code:__________________________

Report

Part A

List Total Wine Gallons for each category

Wine 3.2% -14%

Wine 14.1% -20%

Wine 20.1%-24%

Gallons manufactured

0

0

0

or produced:

__________________________________________________

Deductions

0

0

0

Sacramental Wine

__________________________________________________

0

0

Breakage

__________________________________________________

0

0

0

0

Other (specify)

__________________________________________________

0

0

0

Taxable Gallons

__________________________________________________

Part B

Tax Computation

0

0.00

Wine 3.2% -14% . . . taxable gallons _______________ x $ .93 =

$_____________

0

0.00

Wine 14.1% -20% . . . taxable gallons _______________ x $1.45 =

$_____________

0

0.00

Wine 20.1% -24% . . . taxable gallons _______________ x $2.07 =

$_____________

0.00

Total Tax Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_____________

Signature of Licensee or Preparer ___________________________________________

Send report and payment to: South Dakota Department of Revenue & Regulation, Remit Center,

Box 5055, Sioux Falls, SD 57117-5055

th

Report due on or before the 15

of every month reflecting the previous months production. If no

wine is made then a zero report is due.

PRINT FOR MAILING

CLEAR FORM

Revised 02-2007

1

1