Form Dr 1304 - Gross Conservation Easement Public Information Schedule

ADVERTISEMENT

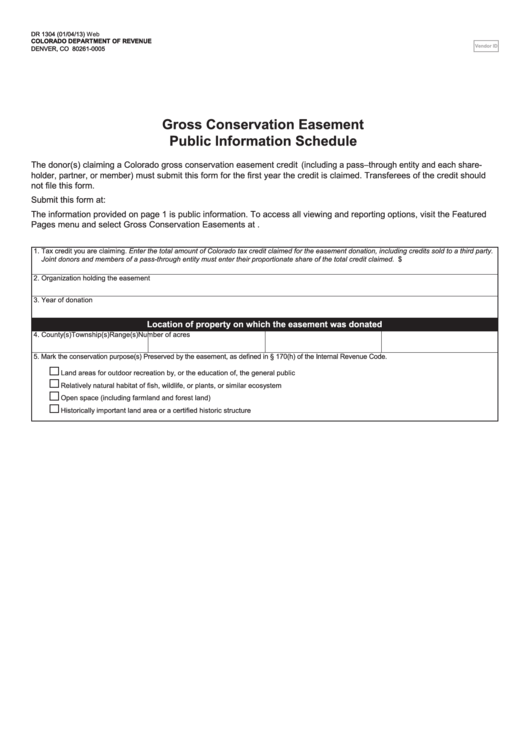

DR 1304 (01/04/13)

DR 1304 (01/04/13) Web

COLORADO DEPARTMENT OF REVENUE

COLORADO DEPARTMENT OF REVENUE

Vendor ID

DENVER, CO 80261-0005

DENVER, CO 80261-0005

Gross Conservation Easement

Public Information Schedule

The donor(s) claiming a Colorado gross conservation easement credit (including a pass–through entity and each share-

holder, partner, or member) must submit this form for the first year the credit is claimed. Transferees of the credit should

not file this form.

Submit this form at:

The information provided on page 1 is public information. To access all viewing and reporting options, visit the Featured

Pages menu and select Gross Conservation Easements at .

1. Tax credit you are claiming. Enter the total amount of Colorado tax credit claimed for the easement donation, including credits sold to a third party.

Joint donors and members of a pass-through entity must enter their proportionate share of the total credit claimed. $

2. Organization holding the easement

3. Year of donation

Location of property on which the easement was donated

4. County(s)

Township(s)

Range(s)

Number of acres

5. Mark the conservation purpose(s) Preserved by the easement, as defined in § 170(h) of the Internal Revenue Code.

Land areas for outdoor recreation by, or the education of, the general public

Relatively natural habitat of fish, wildlife, or plants, or similar ecosystem

Open space (including farmland and forest land)

Historically important land area or a certified historic structure

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2