General Instructions For Filing Business Enterprise & Business Profits Taxes

ADVERTISEMENT

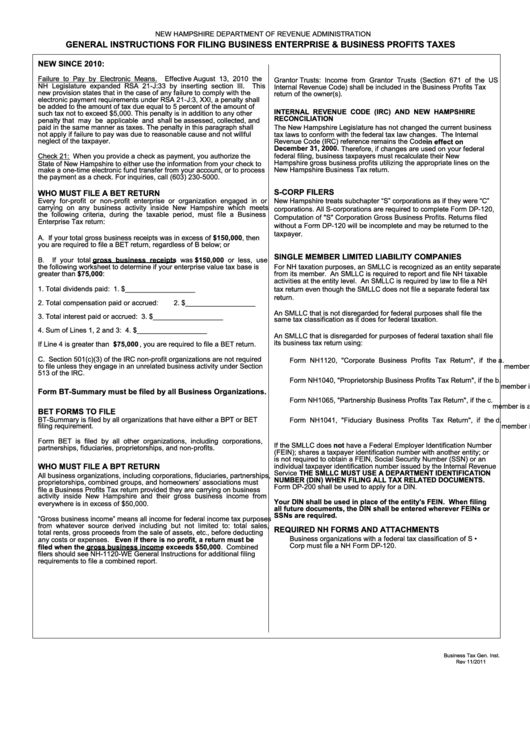

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

GENERAL INSTRUCTIONS FOR FILING BUSINESS ENTERPRISE & BUSINESS PROFITS TAXES

NEW SINCE 2010:

Failure to Pay by Electronic Means.

Effective August 13, 2010 the

Grantor Trusts: Income from Grantor Trusts (Section 671 of the US

NH Legislature expanded RSA 21-J:33 by inserting section III.

This

Internal Revenue Code) shall be included in the Business Profits Tax

new provision states that in the case of any failure to comply with the

return of the owner(s).

electronic payment requirements under RSA 21-J:3, XXI, a penalty shall

be added to the amount of tax due equal to 5 percent of the amount of

INTERNAL REVENUE CODE (IRC) AND NEW HAMPSHIRE

such tax not to exceed $5,000. This penalty is in addition to any other

RECONCILIATION

penalty that may be applicable and shall be assessed, collected, and

paid in the same manner as taxes. The penalty in this paragraph shall

The New Hampshire Legislature has not changed the current business

not apply if failure to pay was due to reasonable cause and not willful

tax laws to conform with the federal tax law changes. The Internal

neglect of the taxpayer.

Revenue Code (IRC) reference remains the Code in effect on

December 31, 2000.

Therefore, if changes are used on your federal

Check 21: When you provide a check as payment, you authorize the

federal filing, business taxpayers must recalculate their New

Hampshire gross business profits utilizing the appropriate lines on the

State of New Hampshire to either use the information from your check to

New Hampshire Business Tax return.

make a one-time electronic fund transfer from your account, or to process

the payment as a check. For inquiries, call (603) 230-5000.

S-CORP FILERS

WHO MUST FILE A BET RETURN

Every for-profit or non-profit enterprise or organization engaged in or

New Hampshire treats subchapter “S” corporations as if they were “C”

carrying on any business activity inside New Hampshire which meets

corporations. All S-corporations are required to complete Form DP-120,

the following criteria, during the taxable period, must file a Business

Computation of "S" Corporation Gross Business Profits. Returns filed

Enterprise Tax return:

without a Form DP-120 will be incomplete and may be returned to the

taxpayer.

A. If your total gross business receipts was in excess of $150,000, then

you are required to file a BET return, regardless of B below; or

SINGLE MEMBER LIMITED LIABILITY COMPANIES

B.

If your total gross business receipts was $150,000 or less, use

the following worksheet to determine if your enterprise value tax base is

For NH taxation purposes, an SMLLC is recognized as an entity separate

greater than $75,000:

from its member. An SMLLC is required to report and file NH taxable

activities at the entity level. An SMLLC is required by law to file a NH

1. Total dividends paid:

1. $__________________

tax return even though the SMLLC does not file a separate federal tax

return.

2. Total compensation paid or accrued:

2. $__________________

An SMLLC that is not disregarded for federal purposes shall file the

3. Total interest paid or accrued:

3. $__________________

same tax classification as it does for federal taxation.

4. Sum of Lines 1, 2 and 3:

4. $__________________

An SMLLC that is disregarded for purposes of federal taxation shall file

its business tax return using:

If Line 4 is greater than $75,000 , you are required to file a BET return.

C. Section 501(c)(3) of the IRC non-profit organizations are not required

a.

Form NH1120, "Corporate Business Profits Tax Return", if the

to file unless they engage in an unrelated business activity under Section

member is a corporation;

513 of the IRC.

b.

Form NH1040, "Proprietorship Business Profits Tax Return", if the

member is an individual;

Form BT-Summary must be filed by all Business Organizations.

c.

Form NH1065, "Partnership Business Profits Tax Return", if the

member is a partnership; and

BET FORMS TO FILE

BT-Summary is filed by all organizations that have either a BPT or BET

d.

Form NH1041, "Fiduciary Business Profits Tax Return", if the

filing requirement.

member is a trust.

Form BET is filed by all other organizations, including corporations,

If the SMLLC does not have a Federal Employer Identification Number

partnerships, fiduciaries, proprietorships, and non-profits.

(FEIN); shares a taxpayer identification number with another entity; or

is not required to obtain a FEIN, Social Security Number (SSN) or an

individual taxpayer identification number issued by the Internal Revenue

WHO MUST FILE A BPT RETURN

Service THE SMLLC MUST USE A DEPARTMENT IDENTIFICATION

All business organizations, including corporations, fiduciaries, partnerships,

NUMBER (DIN) WHEN FILING ALL TAX RELATED DOCUMENTS.

proprietorships, combined groups, and homeowners’ associations must

Form DP-200 shall be used to apply for a DIN.

file a Business Profits Tax return provided they are carrying on business

activity inside New Hampshire and their gross business income from

Your DIN shall be used in place of the entity's FEIN. When filing

everywhere is in excess of $50,000.

all future documents, the DIN shall be entered wherever FEINs or

SSNs are required.

“Gross business income” means all income for federal income tax purposes

from whatever source derived including but not limited to: total sales,

REQUIRED NH FORMS AND ATTACHMENTS

total rents, gross proceeds from the sale of assets, etc., before deducting

•

Business organizations with a federal tax classification of S

any costs or expenses. Even if there is no profit, a return must be

Corp must file a NH Form DP-120.

filed when the gross business income exceeds $50,000. Combined

filers should see NH-1120-WE General Instructions for additional filing

requirements to file a combined report.

Business Tax Gen. Inst.

Rev 11/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3