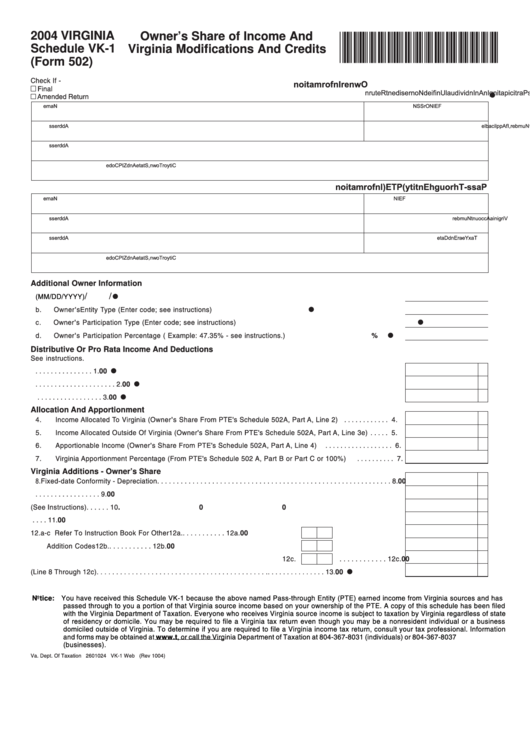

Form 502 - Virginia Schedule Vk-1 - Owner'S Share Of Income And Virginia Modifications And Credits - 2004

ADVERTISEMENT

2004 VIRGINIA

Owner’s Share of Income And

*VA0VK1104888*

Schedule VK-1

Virginia Modifications And Credits

(Form 502)

Check If -

O

w

n

e

I r

f n

r o

m

t a

o i

n

Final

C

h

e

k c

H

e

e r

f I

O

w

n

r e

s I

P

r a

c i t

p i

t a

n i

g

n I

A

n

n I

d

v i

d i

u

l a

U

f i n

e i

d

N

o

n

e r

s

d i

e

t n

R

e

u t

n r

h

w

Amended Return

N

a

m

e

F

E

N I

O

r

S

S

N

A

d

d

e r

s s

i V

g r

n i

a i

A

c c

o

u

t n

N

u

m

b

r e

f I ,

A

p

p

c i l

a

b

e l

A

d

d

e r

s s

C

y t i

r o

o T

w

, n

S

a t

e t

A

n

d

Z

P I

C

o

d

e

P

a

s

s

T -

h

o r

u

g

h

E

n

i t

y t

P (

T

E

I )

f n

r o

m

t a

o i

n

N

a

m

e

F

E

N I

A

d

d

e r

s s

i V

g r

n i

a i

A

c c

o

u

t n

N

u

m

b

r e

A

d

d

e r

s s

a T

x

Y

e

r a

E

n

d

D

a

e t

C

y t i

r o

o T

w

, n

S

a t

e t

A

n

d

Z

P I

C

o

d

e

Additional Owner Information

/

/

w

a. Date Owner Acquired Interest In The Pass-Through Entity (MM/DD/YYYY) ..............................................................

w

b. Owner's Entity Type (Enter code; see instructions) ......................................................................................................

w

c. Owner's Participation Type (Enter code; see instructions) ...........................................................................................

w

d. Owner's Participation Percentage ( Example: 47.35% - see instructions.) .................................................................

%

Distributive Or Pro Rata Income And Deductions

See instructions.

w

1. Total Of Taxable Income Amounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

00

w

2. Total Of Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

00

w

3. Tax-exempt Interest Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

00

Allocation And Apportionment

w

4. Income Allocated To Virginia (Owner's Share From PTE's Schedule 502A, Part A, Line 2) . . . . . . . . . . . . . . . . . 4.

00

w

5. Income Allocated Outside Of Virginia (Owner's Share From PTE's Schedule 502A, Part A, Line 3e) . . . . . . . . . 5.

00

w

6. Apportionable Income (Owner's Share From PTE's Schedule 502A, Part A, Line 4) . . . . . . . . . . . . . . . . . . . . . . 6.

00

w

7. Virginia Apportionment Percentage (From PTE's Schedule 502 A, Part B or Part C or 100%) . . . . . . . . . . . . . . 7.

%

Virginia Additions - Owner’s Share

8. Fixed-date Conformity - Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

00

9. Fixed-date Conformity - Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

00

10. Net Income Tax Or Other Tax Used As A Deduction In Determining Taxable Income (See Instructions) . . . . . . 10.

00

11. Interest On Municipal Or State Obligations Other Than From Virginia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

00

12. a-c Refer To Instruction Book For Other

12a.

. . . . . . . . . . . 12a.

00

Addition Codes

12b.

. . . . . . . . . . . 12b.

00

12c.

. . . . . . . . . . . . 12c.

00

w

13. Total Additions (Line 8 Through 12c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

00

Notice: You have received this Schedule VK-1 because the above named Pass-through Entity (PTE) earned income from Virginia sources and has

passed through to you a portion of that Virginia source income based on your ownership of the PTE. A copy of this schedule has been filed

with the Virginia Department of Taxation. Everyone who receives Virginia source income is subject to taxation by Virginia regardless of state

of residency or domicile. You may be required to file a Virginia tax return even though you may be a nonresident individual or a business

domiciled outside of Virginia. To determine if you are required to file a Virginia income tax return, consult your tax professional. Information

and forms may be obtained at , or call the Virginia Department of Taxation at 804-367-8031 (individuals) or 804-367-8037

(businesses).

Va. Dept. Of Taxation 2601024 VK-1 Web (Rev 1004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2