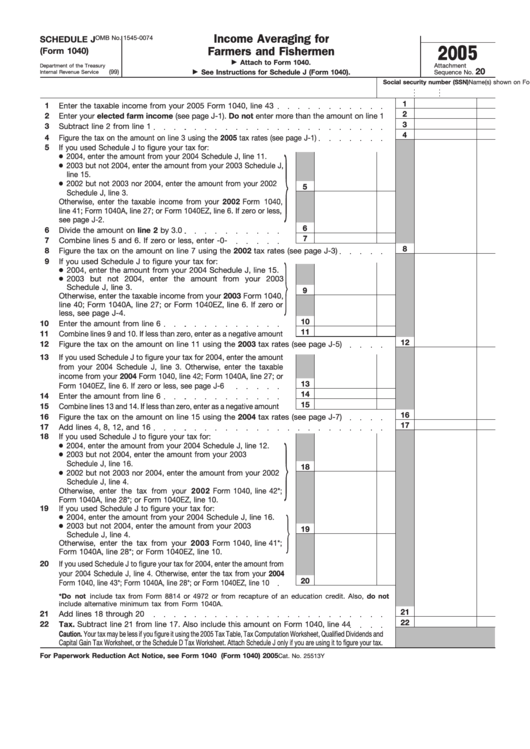

Income Averaging for

OMB No. 1545-0074

SCHEDULE J

2005

Farmers and Fishermen

(Form 1040)

Attach to Form 1040.

Attachment

Department of the Treasury

20

(99)

See Instructions for Schedule J (Form 1040).

Internal Revenue Service

Sequence No.

Name(s) shown on Form 1040

Social security number (SSN)

1

1

Enter the taxable income from your 2005 Form 1040, line 43

2

2

Enter your elected farm income (see page J-1). Do not enter more than the amount on line 1

3

3

Subtract line 2 from line 1

4

4

Figure the tax on the amount on line 3 using the 2005 tax rates (see page J-1)

5

If you used Schedule J to figure your tax for:

● 2004, enter the amount from your 2004 Schedule J, line 11.

● 2003 but not 2004, enter the amount from your 2003 Schedule J,

line 15.

● 2002 but not 2003 nor 2004, enter the amount from your 2002

5

Schedule J, line 3.

Otherwise, enter the taxable income from your 2002 Form 1040,

line 41; Form 1040A, line 27; or Form 1040EZ, line 6. If zero or less,

see page J-2.

6

6

Divide the amount on line 2 by 3.0

7

7

Combine lines 5 and 6. If zero or less, enter -0-

8

8

Figure the tax on the amount on line 7 using the 2002 tax rates (see page J-3)

9

If you used Schedule J to figure your tax for:

● 2004, enter the amount from your 2004 Schedule J, line 15.

● 2003 but not 2004, enter the amount from your 2003

Schedule J, line 3.

9

Otherwise, enter the taxable income from your 2003 Form 1040,

line 40; Form 1040A, line 27; or Form 1040EZ, line 6. If zero or

less, see page J-4.

10

10

Enter the amount from line 6

11

11

Combine lines 9 and 10. If less than zero, enter as a negative amount

12

12

Figure the tax on the amount on line 11 using the 2003 tax rates (see page J-5)

13

If you used Schedule J to figure your tax for 2004, enter the amount

from your 2004 Schedule J, line 3. Otherwise, enter the taxable

income from your 2004 Form 1040, line 42; Form 1040A, line 27; or

13

Form 1040EZ, line 6. If zero or less, see page J-6

14

14

Enter the amount from line 6

15

15

Combine lines 13 and 14. If less than zero, enter as a negative amount

16

16

Figure the tax on the amount on line 15 using the 2004 tax rates (see page J-7)

17

17

Add lines 4, 8, 12, and 16

18

If you used Schedule J to figure your tax for:

● 2004, enter the amount from your 2004 Schedule J, line 12.

● 2003 but not 2004, enter the amount from your 2003

Schedule J, line 16.

18

● 2002 but not 2003 nor 2004, enter the amount from your 2002

Schedule J, line 4.

Otherwise, enter the tax from your 2002 Form 1040, line 42*;

Form 1040A, line 28*; or Form 1040EZ, line 10.

19

If you used Schedule J to figure your tax for:

● 2004, enter the amount from your 2004 Schedule J, line 16.

● 2003 but not 2004, enter the amount from your 2003

19

Schedule J, line 4.

Otherwise, enter the tax from your 2003 Form 1040, line 41*;

Form 1040A, line 28*; or Form 1040EZ, line 10.

20

If you used Schedule J to figure your tax for 2004, enter the amount from

your 2004 Schedule J, line 4. Otherwise, enter the tax from your 2004

20

Form 1040, line 43*; Form 1040A, line 28*; or Form 1040EZ, line 10

*Do not include tax from Form 8814 or 4972 or from recapture of an education credit. Also, do not

include alternative minimum tax from Form 1040A.

21

21

Add lines 18 through 20

22

22

Tax. Subtract line 21 from line 17. Also include this amount on Form 1040, line 44

Caution. Your tax may be less if you figure it using the 2005 Tax Table, Tax Computation Worksheet, Qualified Dividends and

Capital Gain Tax Worksheet, or the Schedule D Tax Worksheet. Attach Schedule J only if you are using it to figure your tax.

For Paperwork Reduction Act Notice, see Form 1040 instructions.

Schedule J (Form 1040) 2005

Cat. No. 25513Y

1

1