Senior Citizen/disabled Veteran Real Property Tax Exemption Application Form - Cbj Assessor'S Office - 2010/2011

ADVERTISEMENT

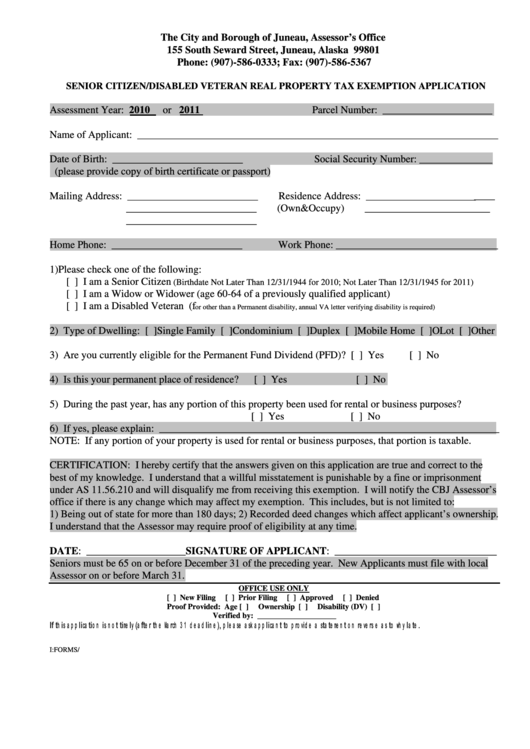

The City and Borough of Juneau, Assessor’s Office

155 South Seward Street, Juneau, Alaska 99801

Phone: (907)-586-0333; Fax: (907)-586-5367

SENIOR CITIZEN/DISABLED VETERAN REAL PROPERTY TAX EXEMPTION APPLICATION

Assessment Year: 2010

or 2011

Parcel Number: _____________________

Name of Applicant: _____________________________________________________________________

Date of Birth: _________________________

Social Security Number: ______________

(please provide copy of birth certificate or passport)

Mailing Address: _________________________

Residence Address: _________________________

_________________________

(Own&Occupy)

________________________

_________________________

Home Phone: _________________________

Work Phone: _______________________________

1) Please check one of the following:

[ ] I am a Senior Citizen

(Birthdate Not Later Than 12/31/1944 for 2010; Not Later Than 12/31/1945 for 2011)

[ ] I am a Widow or Widower (age 60-64 of a previously qualified applicant)

[ ] I am a Disabled Veteran (f

or other than a Permanent disability, annual VA letter verifying disability is required)

2) Type of Dwelling: [ ]Single Family [ ]Condominium [ ]Duplex [ ]Mobile Home [ ]OLot [ ]Other

3) Are you currently eligible for the Permanent Fund Dividend (PFD)? [ ] Yes

[ ] No

4) Is this your permanent place of residence?

[ ] Yes

[ ] No

5) During the past year, has any portion of this property been used for rental or business purposes?

[ ] Yes

[ ] No

6) If yes, please explain: _________________________________________________________________

NOTE: If any portion of your property is used for rental or business purposes, that portion is taxable.

CERTIFICATION: I hereby certify that the answers given on this application are true and correct to the

best of my knowledge. I understand that a willful misstatement is punishable by a fine or imprisonment

under AS 11.56.210 and will disqualify me from receiving this exemption. I will notify the CBJ Assessor’s

office if there is any change which may affect my exemption. This includes, but is not limited to:

1) Being out of state for more than 180 days; 2) Recorded deed changes which affect applicant’s ownership.

I understand that the Assessor may require proof of eligibility at any time.

DATE: ___________________SIGNATURE OF APPLICANT: _______________________________

Seniors must be 65 on or before December 31 of the preceding year. New Applicants must file with local

Assessor on or before March 31.

OFFICE USE ONLY

[ ] New Filing

[ ] Prior Filing

[ ] Approved

[ ] Denied

Proof Provided: Age [ ]

Ownership [ ]

Disability (DV) [ ]

Verified by: ____________________

I:FORMS/20102011SeniorExemptionForm.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1