Schedule Fd - Food Donation Tax Credit Krs 141.392

ADVERTISEMENT

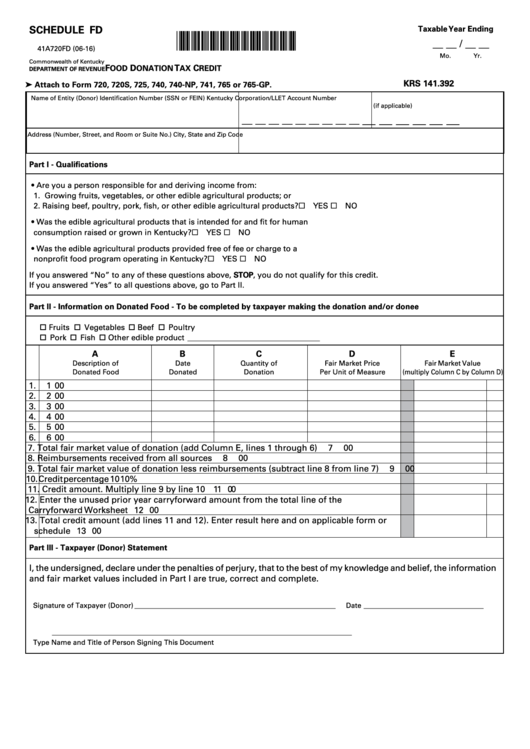

SCHEDULE FD

Taxable Year Ending

*1600010340*

__ __ / __ __

41A720FD (06-16)

Mo.

Yr.

Commonwealth of Kentucky

F

D

T

C

OOD

ONATION

AX

REDIT

DEPARTMENT OF REVENUE

KRS 141.392

➤ Attach to Form 720, 720S, 725, 740, 740-NP , 741, 765 or 765-GP .

Name of Entity (Donor)

Identification Number (SSN or FEIN)

Kentucky Corporation/LLET Account Number

(if applicable)

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

Address (Number, Street, and Room or Suite No.)

City, State and Zip Code

Part I - Qualifications

• Are you a person responsible for and deriving income from:

1. Growing fruits, vegetables, or other edible agricultural products; or

2. Raising beef, poultry, pork, fish, or other edible agricultural products? .................................... ¨ YES ¨ NO

• Was the edible agricultural products that is intended for and fit for human

consumption raised or grown in Kentucky? ...................................................................................... ¨ YES ¨ NO

• Was the edible agricultural products provided free of fee or charge to a

nonprofit food program operating in Kentucky? ............................................................................... ¨ YES ¨ NO

If you answered “No” to any of these questions above, STOP, you do not qualify for this credit.

If you answered “Yes” to all questions above, go to Part II.

Part II - Information on Donated Food - To be completed by taxpayer making the donation and/or donee

Fruits

Vegetables

Beef

Poultry

Pork

Fish

Other edible product __________________________________

A

B

C

D

E

Description of

Date

Quantity of

Fair Market Price

Fair Market Value

Donated Food

Donated

Donation

Per Unit of Measure

(multiply Column C by Column D)

1.

1

00

2.

2

00

3.

3

00

4.

4

00

5.

5

00

6.

6

00

7. Total fair market value of donation (add Column E, lines 1 through 6) ..............................

7

00

8. Reimbursements received from all sources .........................................................................

8

00

9. Total fair market value of donation less reimbursements (subtract line 8 from line 7) ....

9

00

10. Credit percentage

10

10%

11. Credit amount. Multiply line 9 by line 10 ..............................................................................

11

00

12. Enter the unused prior year carryforward amount from the total line of the

Carryforward Worksheet ......................................................................................................... 12

00

13. Total credit amount (add lines 11 and 12). Enter result here and on applicable form or

schedule ................................................................................................................................... 13

00

Part III - Taxpayer (Donor) Statement

I, the undersigned, declare under the penalties of perjury, that to the best of my knowledge and belief, the information

and fair market values included in Part I are true, correct and complete.

Signature of Taxpayer (Donor) _________________________________________________________

Date __________________________________

_____________________________________________________________________________________

Type Name and Title of Person Signing This Document

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2