Form 322 - Annual Reconciliation Of Compensation Tax Withheld From Wages

ADVERTISEMENT

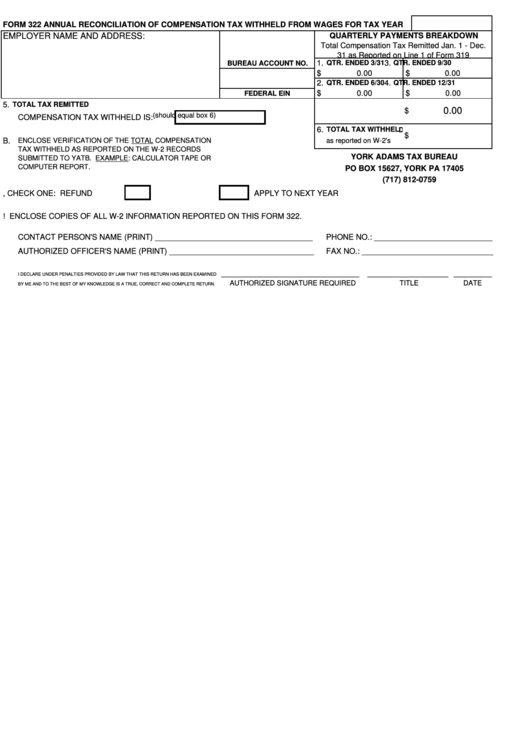

FORM 322 ANNUAL RECONCILIATION OF COMPENSATION TAX WITHHELD FROM WAGES FOR TAX YEAR

EMPLOYER NAME AND ADDRESS:

QUARTERLY PAYMENTS BREAKDOWN

Total Compensation Tax Remitted Jan. 1 - Dec.

31 as Reported on Line 1 of Form 319

1.

3.

BUREAU ACCOUNT NO.

QTR. ENDED 3/31

QTR. ENDED 9/30

$

0.00

$

0.00

2.

QTR. ENDED 6/30

4.

QTR. ENDED 12/31

$

0.00

$

0.00

FEDERAL EIN

5.

A. NUMBER OF W-2 RECORDS REPORTING LOCAL

TOTAL TAX REMITTED

0.00

$

(should equal box 6)

COMPENSATION TAX WITHHELD IS:

6.

TOTAL TAX WITHHELD

$

B.

ENCLOSE VERIFICATION OF THE TOTAL COMPENSATION

as reported on W-2's

TAX WITHHELD AS REPORTED ON THE W-2 RECORDS

YORK ADAMS TAX BUREAU

SUBMITTED TO YATB. EXAMPLE: CALCULATOR TAPE OR

COMPUTER REPORT.

PO BOX 15627, YORK PA 17405

(717) 812-0759

C. IF OVERPAID, CHECK ONE:

REFUND

APPLY TO NEXT YEAR

D. IMPORTANT! ENCLOSE COPIES OF ALL W-2 INFORMATION REPORTED ON THIS FORM 322.

CONTACT PERSON'S NAME (PRINT) ____________________________________

PHONE NO.: ___________________________

AUTHORIZED OFFICER'S NAME (PRINT) _________________________________

FAX NO.: ______________________________

_____________________________

_________________

________

I DECLARE UNDER PENALTIES PROVIDED BY LAW THAT THIS RETURN HAS BEEN EXAMINED

AUTHORIZED SIGNATURE REQUIRED

TITLE

DATE

BY ME AND TO THE BEST OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1