Employer'S Withholding Registration Form - City Of Ionia Income Tax Divison

ADVERTISEMENT

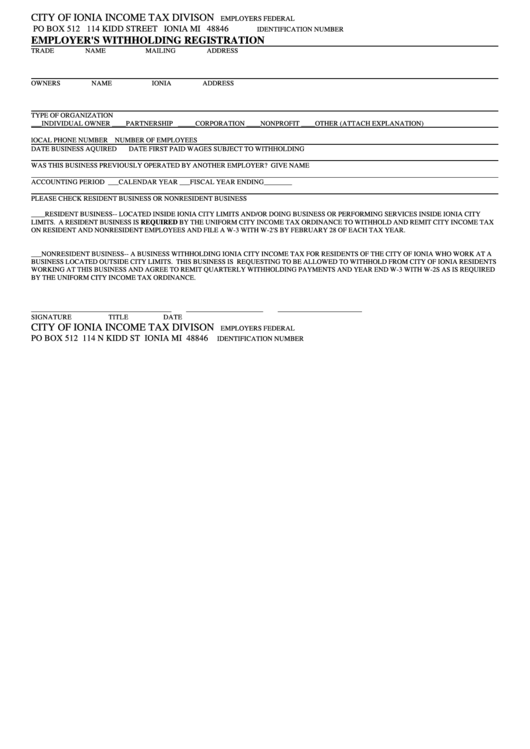

CITY OF IONIA

INCOME TAX DIVISON

EMPLOYERS FEDERAL

PO BOX 512 114 KIDD STREET IONIA MI 48846

IDENTIFICATION NUMBER

EMPLOYER'S WITHHOLDING REGISTRATION

TRADE NAME

MAILING ADDRESS

OWNERS NAME

IONIA ADDRESS

TYPE OF ORGANIZATION

___INDIVIDUAL OWNER

____PARTNERSHIP _____CORPORATION ____NONPROFIT ____OTHER (ATTACH EXPLANATION)

lOCAL PHONE NUMBER

NUMBER OF EMPLOYEES

DATE BUSINESS AQUIRED

DATE FIRST PAID WAGES SUBJECT TO WITHHOLDING

WAS THIS BUSINESS PREVIOUSLY OPERATED BY ANOTHER EMPLOYER?

GIVE NAME

ACCOUNTING PERIOD ___CALENDAR YEAR

___FISCAL YEAR ENDING________

PLEASE CHECK RESIDENT BUSINESS OR NONRESIDENT BUSINESS

____RESIDENT BUSINESS-- LOCATED INSIDE IONIA CITY LIMITS AND/OR DOING BUSINESS OR PERFORMING SERVICES INSIDE IONIA CITY

LIMITS. A RESIDENT BUSINESS IS REQUIRED BY THE UNIFORM CITY INCOME TAX ORDINANCE TO WITHHOLD AND REMIT CITY INCOME TAX

ON RESIDENT AND NONRESIDENT EMPLOYEES AND FILE A W-3 WITH W-2'S BY FEBRUARY 28 OF EACH TAX YEAR.

___NONRESIDENT BUSINESS-- A BUSINESS WITHHOLDING IONIA CITY INCOME TAX FOR RESIDENTS OF THE CITY OF IONIA WHO WORK AT A

BUSINESS LOCATED OUTSIDE CITY LIMITS. THIS BUSINESS IS REQUESTING TO BE ALLOWED TO WITHHOLD FROM CITY OF IONIA RESIDENTS

WORKING AT THIS BUSINESS AND AGREE TO REMIT QUARTERLY WITHHOLDING PAYMENTS AND YEAR END W-3 WITH W-2S AS IS REQUIRED

BY THE UNIFORM CITY INCOME TAX ORDINANCE.

________________________________________

______________________

________________________

SIGNATURE

TITLE

DATE

CITY OF IONIA

INCOME TAX DIVISON

EMPLOYERS FEDERAL

PO BOX 512 114 N KIDD ST IONIA MI 48846

IDENTIFICATION NUMBER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1