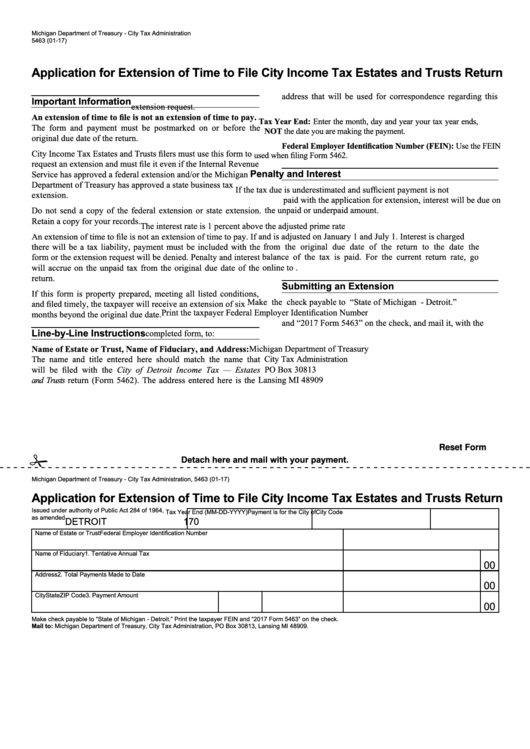

Michigan Department of Treasury - City Tax Administration

5463 (01-17)

Application for Extension of Time to File City Income Tax Estates and Trusts Return

address that will be used for correspondence regarding this

Important Information

extension request.

An extension of time to file is not an extension of time to pay.

Tax Year End: Enter the month, day and year your tax year ends,

The form and payment must be postmarked on or before the

NOT the date you are making the payment.

original due date of the return.

Federal Employer Identification Number (FEIN): Use the FEIN

City Income Tax Estates and Trusts filers must use this form to

used when filing Form 5462.

request an extension and must file it even if the Internal Revenue

Penalty and Interest

Service has approved a federal extension and/or the Michigan

Department of Treasury has approved a state business tax

If the tax due is underestimated and sufficient payment is not

extension.

paid with the application for extension, interest will be due on

the unpaid or underpaid amount.

Do not send a copy of the federal extension or state extension.

Retain a copy for your records.

The interest rate is 1 percent above the adjusted prime rate

An extension of time to file is not an extension of time to pay. If

and is adjusted on January 1 and July 1. Interest is charged

from the original due date of the return to the date the

there will be a tax liability, payment must be included with the

form or the extension request will be denied. Penalty and interest

balance of the tax is paid. For the current return rate, go

online to

will accrue on the unpaid tax from the original due date of the

return.

Submitting an Extension

If this form is property prepared, meeting all listed conditions,

Make the check payable to “State of Michigan - Detroit.”

and filed timely, the taxpayer will receive an extension of six

Print the taxpayer Federal Employer Identification Number

months beyond the original due date.

and “2017 Form 5463” on the check, and mail it, with the

Line-by-Line Instructions

completed form, to:

Name of Estate or Trust, Name of Fiduciary, and Address:

Michigan Department of Treasury

City Tax Administration

The name and title entered here should match the name that

will be filed with the City of Detroit Income Tax — Estates

PO Box 30813

Lansing MI 48909

and Trusts return (Form 5462). The address entered here is the

Reset Form

#

Detach here and mail with your payment.

Michigan Department of Treasury - City Tax Administration, 5463 (01-17)

Application for Extension of Time to File City Income Tax Estates and Trusts Return

Issued under authority of Public Act 284 of 1964,

Tax Year End (MM-DD-YYYY)

Payment is for the City of

City Code

as amended

DETROIT

170

Name of Estate or Trust

Federal Employer Identification Number

Name of Fiduciary

1. Tentative Annual Tax

00

Address

2. Total Payments Made to Date

00

City

State

ZIP Code

3. Payment Amount

00

Make check payable to “State of Michigan - Detroit.” Print the taxpayer FEIN and “2017 Form 5463” on the check.

Mail to: Michigan Department of Treasury, City Tax Administration, PO Box 30813, Lansing MI 48909.

1

1