Form St-5 - Exempt Organization Certificate

ADVERTISEMENT

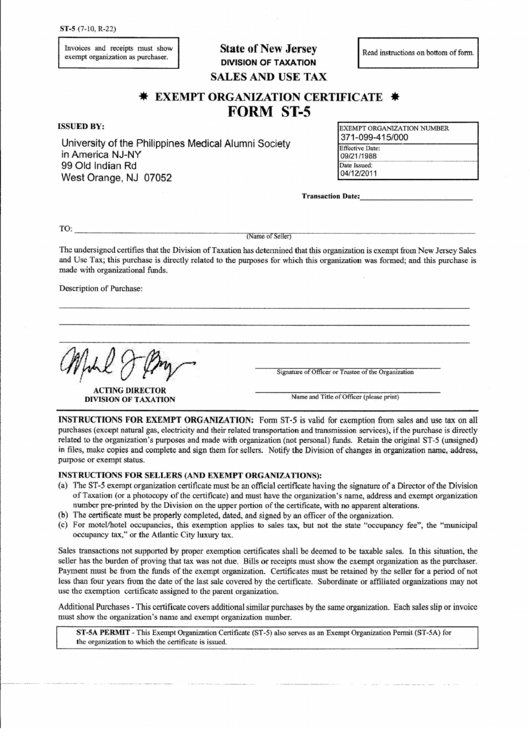

ST-5 (7-10, R-22)

Invoices and receipts must show

exempt organization as purchaser.

State of New Jersey

DIVISION OF TAXATION

Read instructions on bottom of form.

SALES AND USE TAX

*

EXEMPT ORGANIZATION CERTIFICATE

*

FORM ST-5

ISSUED BY:

University of the Philippines Medical Alumni Society

in America NJ-NY

99 Old Indian Rd

West Orange, NJ 07052

EXEMPT ORGANIZATION NUMBER

371-099-415/000

Effective Date:

09/21/1988

Date Issued:

04/12/2011

Transaction

Date:.

_

TO:

~==~==~-------------------------------

(Name of Seller)

The undersigned certifies that the Division of Taxation has determined that this organization is exempt from New Jersey Sales

and Use Tax; this purchase is directly related to the purposes for which this organization was formed; and this purchase is

made with organizational funds.

Description of Purchase:

Signature of Officer or Trustee of the Organization

ACTING DIRECTOR

DIVISION OF TAXATION

Name and Title of Officer (please print)

INSTRUCTIONS

FOR EXEMPT ORGANIZATION:

Form ST-5 is valid for exemption from sales and use tax on all

purchases (except natural gas, electricity and their related transportation and transmission services), if the purchase is directly

related to the organization's purposes and made with organization (not personal) funds. Retain the original ST-5 (unsigned)

in files, make copies and complete and sign them for sellers. Notify the Division of changes in organization name, address,

purpose or exempt status.

INSTRUCTIONS

FOR SELLERS (AND EXEMPT ORGANIZATIONS):

(a) The ST-5 exempt organization certificate must be an official certificate having the signature of a Director of the Division

of Taxation (or a photocopy of the certificate) and must have the organization's name, address and exempt organization

number pre-printed by the Division on the upper portion of the certificate, with no apparent alterations.

(b) The certificate must be properly completed, dated, and signed by an officer of the organization.

(c) For motellhotel occupancies, this exemption applies to sales tax, but not the state "occupancy fee", the "municipal

occupancy tax," or the Atlantic City luxury tax.

Sales transactions not supported by proper exemption certificates shall be deemed to be taxable sales. In this situation, the

seller has the burden of proving that tax was not due. Bills or receipts must show the exempt organization as the purchaser.

Payment must be from the funds of the exempt organization. Certificates must be retained by the seller for a period of not

less than four years from the date of the last sale covered by the certificate. Subordinate or affiliated organizations may not

use the exemption certificate assigned to the parent organization.

Additional Purchases - This certificate covers additional similar purchases by the same organization. Each sales slip or invoice

must show the organization's name and exempt organization number.

ST-SA PERMIT - This Exempt Organization Certificate (ST-S) also serves as an Exempt Organization Permit (ST-SA) for

the organization to which the certificate is issued.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1