Reset Form

Print Form

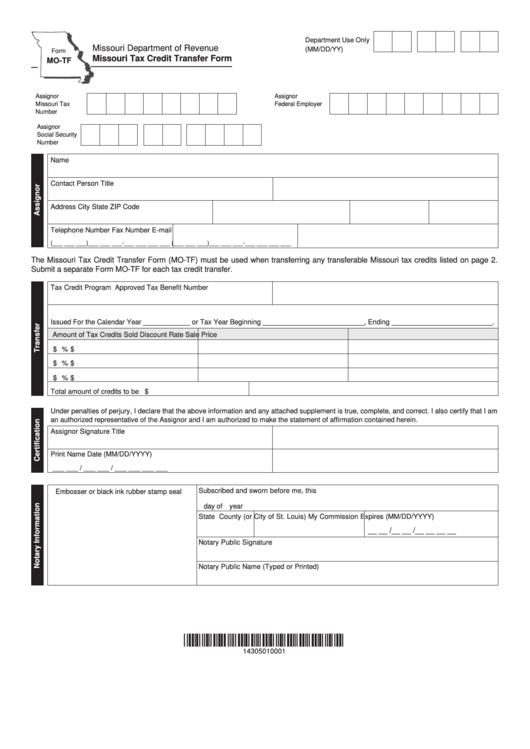

Department Use Only

Missouri Department of Revenue

(MM/DD/YY)

Form

Missouri Tax Credit Transfer Form

MO-TF

Assignor

Assignor

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Assignor

Social Security

Number

Name

Contact Person

Title

Address

City

State

ZIP Code

Telephone Number

Fax Number

E-mail

(___ ___ ___)___ ___ ___-___ ___ ___ ___

(___ ___ ___)___ ___ ___-___ ___ ___ ___

The Missouri Tax Credit Transfer Form (MO-TF) must be used when transferring any transferable Missouri tax credits listed on page 2.

Submit a separate Form MO-TF for each tax credit transfer.

Tax Credit Program

Approved Tax Benefit Number

Issued For the Calendar Year ____________ or Tax Year Beginning __________________________, Ending __________________________.

Amount of Tax Credits Sold

Discount Rate

Sale Price

$

%

$

$

%

$

$

%

$

Total amount of credits to be transferred.....................................

$

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. I also certify that I am

an authorized representative of the Assignor and I am authorized to make the statement of affirmation contained herein.

Assignor Signature

Title

Print Name

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Subscribed and sworn before me, this

Embosser or black ink rubber stamp seal

day of

year

State

County (or City of St. Louis)

My Commission Expires (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Notary Public Signature

Notary Public Name (Typed or Printed)

*14305010001*

14305010001

1

1 2

2 3

3