Instructions For Transmittal Of 1099-Sf Forms

ADVERTISEMENT

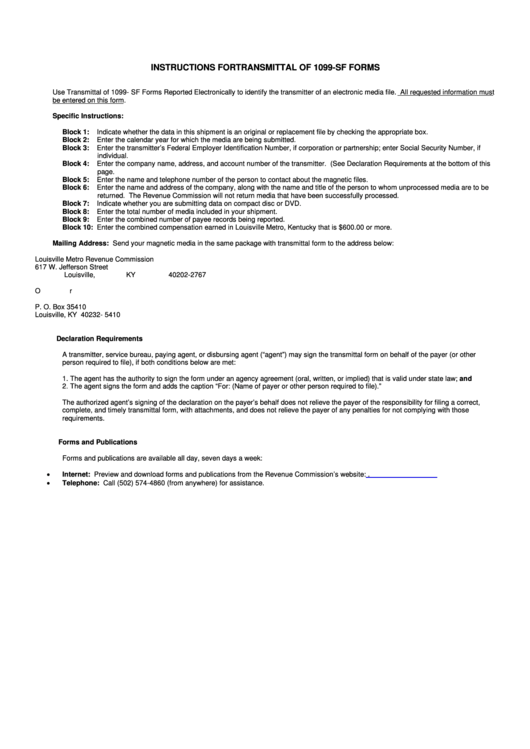

INSTRUCTIONS FOR TRANSMITTAL OF 1099-SF FORMS

Use Transmittal of 1099- SF Forms Reported Electronically to identify the transmitter of an electronic media file. All requested information must

be entered on this form.

Specific Instructions:

Block 1:

Indicate whether the data in this shipment is an original or replacement file by checking the appropriate box.

Block 2:

Enter the calendar year for which the media are being submitted.

Block 3:

Enter the transmitter’s Federal Employer Identification Number, if corporation or partnership; enter Social Security Number, if

individual.

Block 4:

Enter the company name, address, and account number of the transmitter. (See Declaration Requirements at the bottom of this

page.

Block 5:

Enter the name and telephone number of the person to contact about the magnetic files.

Block 6:

Enter the name and address of the company, along with the name and title of the person to whom unprocessed media are to be

returned. The Revenue Commission will not return media that have been successfully processed.

Block 7:

Indicate whether you are submitting data on compact disc or DVD.

Block 8:

Enter the total number of media included in your shipment.

Block 9:

Enter the combined number of payee records being reported.

Block 10: Enter the combined compensation earned in Louisville Metro, Kentucky that is $600.00 or more.

Mailing Address: Send your magnetic media in the same package with transmittal form to the address below:

Louisville Metro Revenue Commission

617 W. Jefferson Street

Louisville, KY 40202-2767

Or

P. O. Box 35410

Louisville, KY 40232- 5410

Declaration Requirements

A transmitter, service bureau, paying agent, or disbursing agent (“agent”) may sign the transmittal form on behalf of the payer (or other

person required to file), if both conditions below are met:

1.

The agent has the authority to sign the form under an agency agreement (oral, written, or implied) that is valid under state law; and

2.

The agent signs the form and adds the caption “For: (Name of payer or other person required to file).”

The authorized agent’s signing of the declaration on the payer’s behalf does not relieve the payer of the responsibility for filing a correct,

complete, and timely transmittal form, with attachments, and does not relieve the payer of any penalties for not complying with those

requirements.

Forms and Publications

Forms and publications are available all day, seven days a week:

•

Internet: Preview and download forms and publications from the Revenue Commission’s website:

•

Telephone: Call (502) 574-4860 (from anywhere) for assistance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5