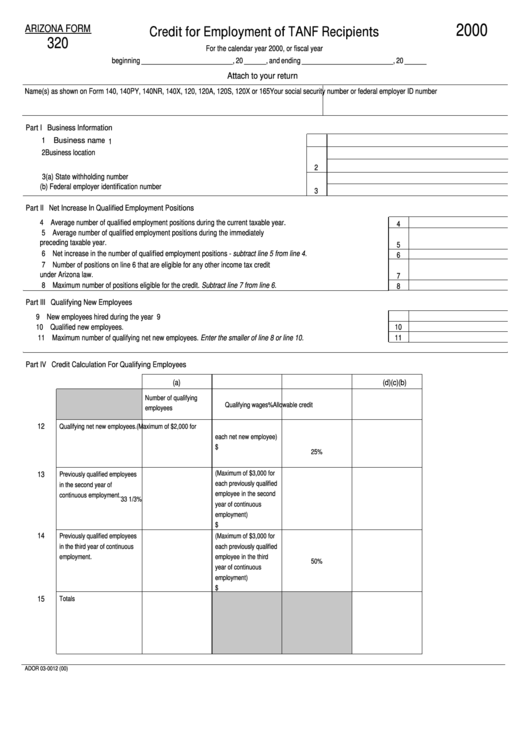

Form 320 - Credit For Employment Of Tanf Recipients - 2000

ADVERTISEMENT

2000

ARIZONA FORM

Credit for Employment of TANF Recipients

320

For the calendar year 2000, or fiscal year

beginning _________________________, 20 ______, and ending _________________________, 20 ______

Attach to your return

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165

Your social security number or federal employer ID number

Part I Business Information

1

Business name ..............................................................................................................

1

2 Business location ................................................................................................................

2

3 (a) State withholding number .............................................................................................

(b) Federal employer identification number ........................................................................

3

Part II Net Increase In Qualified Employment Positions

4 Average number of qualified employment positions during the current taxable year. ......................................................

4

5 Average number of qualified employment positions during the immediately

preceding taxable year. ....................................................................................................................................................

5

6 Net increase in the number of qualified employment positions - subtract line 5 from line 4. ............................................

6

7 Number of positions on line 6 that are eligible for any other income tax credit

under Arizona law. ............................................................................................................................................................

7

8 Maximum number of positions eligible for the credit. Subtract line 7 from line 6. .............................................................

8

Part III Qualifying New Employees

9 New employees hired during the year ..............................................................................................................................

9

10 Qualified new employees. .................................................................................................................................................

10

11

11 Maximum number of qualifying net new employees. Enter the smaller of line 8 or line 10. .............................................

Part IV Credit Calculation For Qualifying Employees

(a)

(b)

(c)

(d)

Number of qualifying

Qualifying wages

%

Allowable credit

employees

12

Qualifying net new employees.

(Maximum of $2,000 for

each net new employee)

$

25%

(Maximum of $3,000 for

13

Previously qualified employees

each previously qualified

in the second year of

employee in the second

continuous employment.

33 1/3%

year of continuous

employment)

$

14

Previously qualified employees

(Maximum of $3,000 for

in the third year of continuous

each previously qualified

employment.

employee in the third

50%

year of continuous

employment)

$

15

Totals

ADOR 03-0012 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2