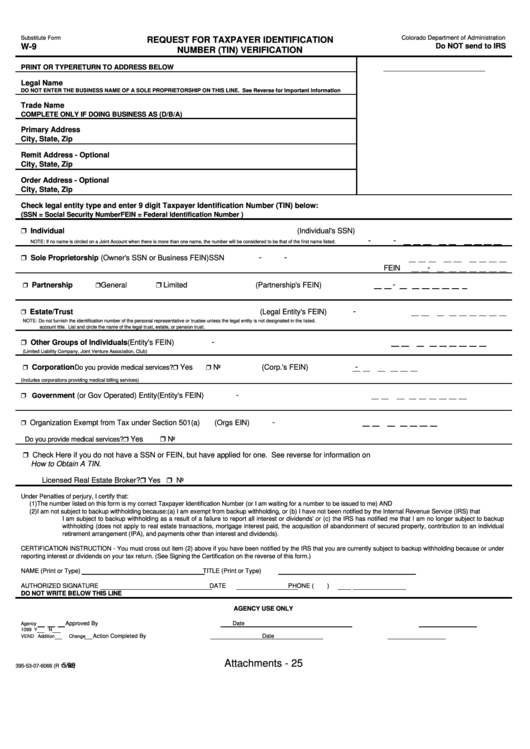

Form W-9 - Request For Taxpayer Identification Number (Tin) Verification

ADVERTISEMENT

Colorado Department of Administration

Substitute Form

REQUEST FOR TAXPAYER IDENTIFICATION

W-9

Do NOT send to IRS

NUMBER (TIN) VERIFICATION

PRINT OR TYPE

RETURN TO ADDRESS BELOW

Legal Name

DO NOT ENTER THE BUSINESS NAME OF A SOLE PROPRIETORSHIP ON THIS LINE. See Reverse for Important Information

Trade Name

COMPLETE ONLY IF DOING BUSINESS AS (D/B/A)

Primary Address

City, State, Zip

Remit Address - Optional

City, State, Zip

Order Address - Optional

City, State, Zip

Check legal entity type and enter 9 digit Taxpayer Identification Number (TIN) below:

(SSN = Social Security Number

FEIN = Federal Identification Number )

” Individual

(Individual's SSN)

-

-

NOTE: If no name is circled on a Joint Account when there is more than one name, the number will be considered to be that of the first name listed.

” Sole Proprietorship (Owner's SSN or Business FEIN)

-

-

SSN

-

FEIN

” Limited

-

”

”

Partnership

General

(Partnership's FEIN)

-

”

Estate/Trust

(Legal Entity's FEIN)

NOTE: Do not furnish the identification number of the personal representative or trustee unless the legal entity is not designated in the listed.

account title. List and circle the name of the legal trust, estate, or pension trust.

” Other Groups of Individuals

-

(Entity's FEIN)

(Limited Liability Company, Joint Venture Association, Club)

-

”

”

”

Corporation

Yes

No

(Corp.'s FEIN)

Do you provide medical services?

(Includes corporations providing medical billing services)

-

” G

overnment (or Gov Operated) Entity

(Entity's FEIN)

-

”

Organization Exempt from Tax under Section 501(a)

(Orgs EIN)

” No

Do you provide medical services? ”

Yes

” Check Here if you do not have a SSN or FEIN, but have applied for one. See reverse for information on

How to Obtain A TIN.

” Yes ” No

Licensed Real Estate Broker?

Under Penalties of perjury, I certify that:

(1)

The number listed on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me) AND

(2)

I am not subject to backup withholding because:(a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that

I am subject to backup withholding as a result of a failure to report all interest or dividends' or (c) the IRS has notified me that I am no longer subject to backup

withholding (does not apply to real estate transactions, mortgage interest paid, the acquisition of abandonment of secured property, contribution to an individual

retirement arrangement (IPA), and payments other than interest and dividends).

CERTIFICATION INSTRUCTION - You must cross out item (2) above if you have been notified by the IRS that you are currently subject to backup withholding because or under

reporting interest or dividends on your tax return. (See Signing the Certification on the reverse of this form.)

NAME (Print or Type)

TITLE (Print or Type)

AUTHORIZED SIGNATURE

DATE

PHONE (

)

DO NOT WRITE BELOW THIS LINE

AGENCY USE ONLY

Approved By

Date

Agency

1099 Y

N

Action Completed By

Date

VEND Addition

Change

Attachments - 25

5/99

395-53-07-6066 (R 11/92)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1