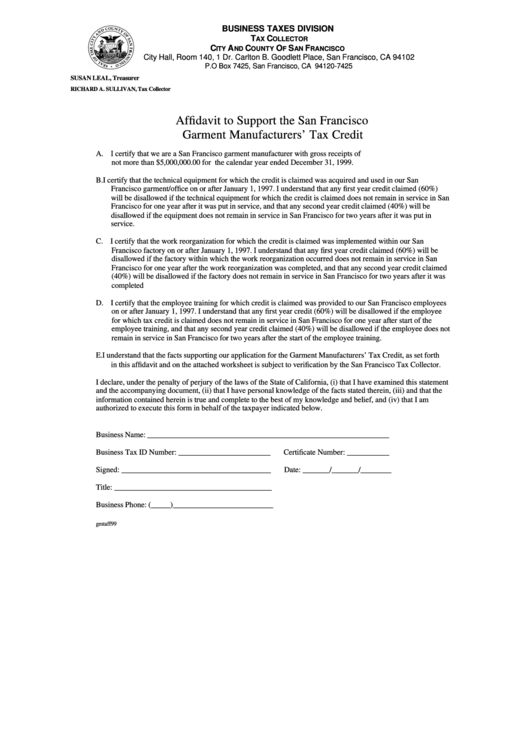

Form Gmtaff99 - Affidavit To Support The San Francisco Garment Manufacturers' Tax Credit

ADVERTISEMENT

BUSINESS TAXES DIVISION

T

C

AX

OLLECTOR

C

A

C

O

S

F

ITY

ND

OUNTY

F

AN

RANCISCO

City Hall, Room 140, 1 Dr. Carlton B. Goodlett Place, San Francisco, CA 94102

P.O Box 7425, San Francisco, CA 94120-7425

SUSAN LEAL, Treasurer

RICHARD A. SULLIVAN, Tax Collector

Affidavit to Support the San Francisco

Garment Manufacturers’ Tax Credit

A. I certify that we are a San Francisco garment manufacturer with gross receipts of

not more than $5,000,000.00 for the calendar year ended December 31, 1999.

B. I certify that the technical equipment for which the credit is claimed was acquired and used in our San

Francisco garment/office on or after January 1, 1997. I understand that any first year credit claimed (60%)

will be disallowed if the technical equipment for which the credit is claimed does not remain in service in San

Francisco for one year after it was put in service, and that any second year credit claimed (40%) will be

disallowed if the equipment does not remain in service in San Francisco for two years after it was put in

service.

C. I certify that the work reorganization for which the credit is claimed was implemented within our San

Francisco factory on or after January 1, 1997. I understand that any first year credit claimed (60%) will be

disallowed if the factory within which the work reorganization occurred does not remain in service in San

Francisco for one year after the work reorganization was completed, and that any second year credit claimed

(40%) will be disallowed if the factory does not remain in service in San Francisco for two years after it was

completed

D. I certify that the employee training for which credit is claimed was provided to our San Francisco employees

on or after January 1, 1997. I understand that any first year credit (60%) will be disallowed if the employee

for which tax credit is claimed does not remain in service in San Francisco for one year after start of the

employee training, and that any second year credit claimed (40%) will be disallowed if the employee does not

remain in service in San Francisco for two years after the start of the employee training.

E. I understand that the facts supporting our application for the Garment Manufacturers’ Tax Credit, as set forth

in this affidavit and on the attached worksheet is subject to verification by the San Francisco Tax Collector.

I declare, under the penalty of perjury of the laws of the State of California, (i) that I have examined this statement

and the accompanying document, (ii) that I have personal knowledge of the facts stated therein, (iii) and that the

information contained herein is true and complete to the best of my knowledge and belief, and (iv) that I am

authorized to execute this form in behalf of the taxpayer indicated below.

Business Name: _______________________________________________________________

Business Tax ID Number: ________________________

Certificate Number: ___________

Signed: _______________________________________

Date: _______/_______/________

Title: _________________________________________

Business Phone: (_____)__________________________

gmtaff99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1