Cca Form 120-18 - Application For Refund Page 2

ADVERTISEMENT

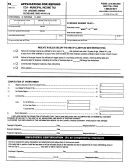

WORKSHEET FOR MULTIPLE EMPLOYERS

Wages and Taxes Reported on W-2 Form:

Employer’s Name

Wages per W-2

Tax Withheld

City Name

1.)

$

$

2.)

$

$

$

$

3.)

+

+

Total Wages:

Total Tax Withheld:

$

$

enter on front page Line 1

enter on front page Line 5

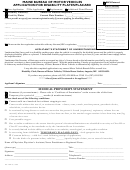

Adjustments to Taxable Income:

Wages per W-2

-

Wages not Subject to Tax

=

Net Taxable Wages

1.)

-

=

$

$

2.)

$

$

-

=

-

=

$

$

3.)

+

+

Total Amount Not Subject to Tax:

Total Net Taxable Wages:

$

$

enter on front page Line 3

enter on front page Line 2

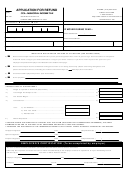

Computation of Corrected Tax:

City Worked

Net Taxable Wages

Tax Rate

Corrected Tax

1.)

X

=

$

%

$

2.)

$

%

$

X

=

X

=

$

%

$

3.)

+

Total Corrected Tax: enter on front page Line 4

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2